Analyzing Recent Trends in the Cryptocurrency Market: Is It Too Late to Invest in Bitcoin?

The dynamic nature of the cryptocurrency market has once again sparked discussions among investors, especially following the rallies in November and early December, and the subsequent downturns. Many potential investors are questioning whether they have missed the opportunity to enter the Bitcoin (BTC) market.

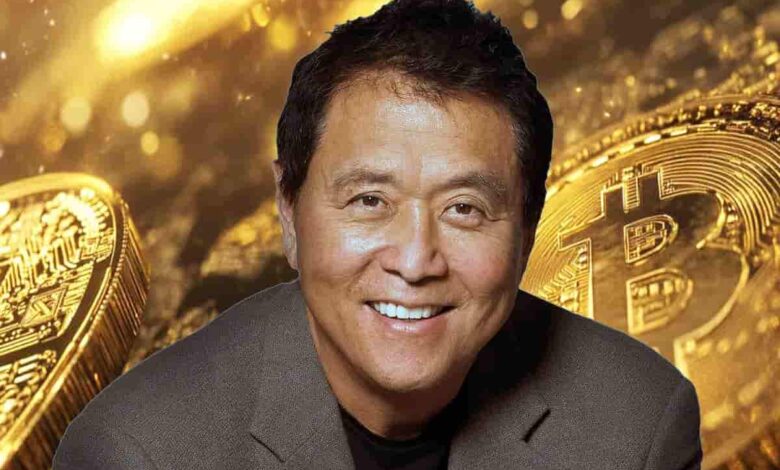

Robert Kiyosaki’s Perspective on Investing in Bitcoin

Renowned investor and author of the bestselling book ‘Rich Dad Poor Dad,’ Robert Kiyosaki, has weighed in on this debate. In a candid social media post, he reassured investors that it is never too late to invest in Bitcoin. He emphasized that Bitcoin is designed to create wealth for all investors, including those who enter the market later. Kiyosaki reminded his followers, however, to exercise caution and avoid greed in their investment strategies.

Is Following Kiyosaki’s Advice a Wise Move for Investors?

Kiyosaki’s investment philosophy has been consistent, focusing on assets like Bitcoin, gold, and silver. Those who have followed his advice have seen significant returns in 2024. Particularly for Bitcoin, investors who bought in before mid-November have witnessed substantial gains despite the market’s recent volatility.

However, examining the broader picture reveals limitations in Kiyosaki’s advice. Investors who bought at the peak in 2021 and lacked the financial resilience to endure the subsequent ‘crypto winter’ faced significant losses. Kiyosaki’s guidance seems best suited for individuals with strong financial buffers, allowing them to embrace high-risk investments. Notably, Kiyosaki himself has a considerable portion of his wealth leveraged through debt, amounting to over $1 billion.

Moreover, Kiyosaki’s sincerity is sometimes questioned, particularly when he advises selling homes to invest in Bitcoin while owning numerous properties himself.

Can Investing in Bitcoin This December Truly Make Everyone Rich?

The effectiveness of Kiyosaki’s recent investment advice remains uncertain. While some experts, like Tom Lee, predict a bright future for Bitcoin with price targets reaching $250,000 in 2025, others remain cautious due to the current market downturn. The recent declines in digital assets, exacerbated by announcements from the Federal Reserve, have raised concerns about the reliability of cryptocurrencies as a hedge against economic instability.

Kiyosaki has consistently positioned Bitcoin, along with gold and silver, as safeguards against the catastrophic economic collapse he often predicts. However, whether these assets will deliver on that promise remains a topic of debate.

Disclaimer: The information presented in this article is for informational purposes only and should not be considered financial advice. Always conduct thorough research before making investment decisions.

“`

This version of the content has been restructured with appropriate HTML headings, enhanced with relevant keywords for SEO, and expanded to provide a comprehensive overview of the topic.