Bitcoin’s Resurgence: A Strategic Perspective from Robert Kiyosaki

The Unexpected Bitcoin Surge and Kiyosaki’s Critique

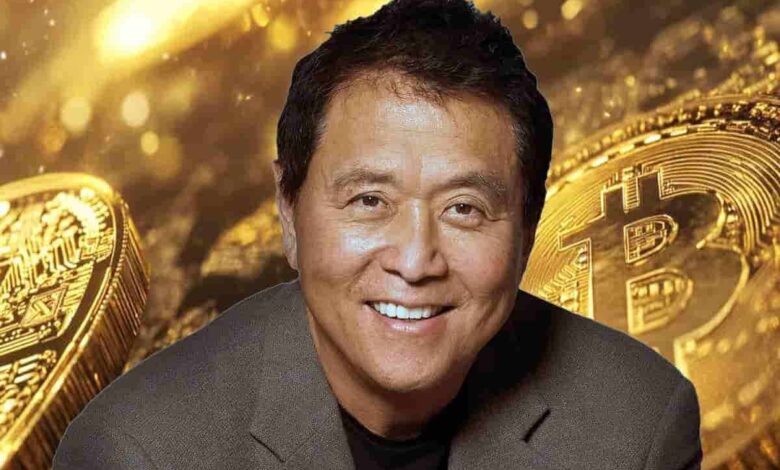

In a remarkable development, Bitcoin (BTC) surged past the $90,000 mark during a late-night rally. The renowned investor and author of the influential book “Rich Dad Poor Dad,” Robert Kiyosaki, took to social media platform X to express his criticism of investors who disposed of their cryptocurrency holdings during the previous market downturn. His message was blunt:

“Those Who Sold Bitcoin in the Last Crash Are Losers”

Drawing on his financial acumen, Kiyosaki disclosed that he capitalized on the market dip by acquiring more Bitcoin. He attributed his optimism to the political climate, suggesting that Donald Trump’s presidency plays a pivotal role in Bitcoin’s potential growth trajectory.

The Implications of a Strategic Bitcoin Reserve

Kiyosaki posits that Bitcoin is poised for a significant upswing once the federal government starts accumulating it to address economic challenges. He predicts that individuals who purchased during the downturn will be vindicated as “winners,” while those who sold will face regret.

The Trump Administration’s Bitcoin Strategy

President Trump has floated the idea of establishing a strategic Bitcoin reserve, hinting at it through various statements and preliminary initiatives. Despite these announcements stirring the cryptocurrency market, as evidenced by the recent rally, there remains uncertainty about the U.S. government’s commitment to amassing a cryptocurrency reserve.

Senator Cynthia Lummis, a staunch advocate for a Bitcoin reserve, noted in February 2025 that federal acquisition of Bitcoin remains unlikely in the near term. She anticipates that individual states might take the lead in creating such reserves, given the current lack of congressional support and expertise among lawmakers.

The Validity of Kiyosaki’s Investment Advice

While the future of a strategic Bitcoin reserve under President Trump remains uncertain, Kiyosaki’s investment strategy may hold merit. His assertion that buying during a downturn is preferable to selling is a time-tested investment principle. However, his past behavior raises questions about potential self-interest in his advice.

Despite the unpredictable nature of the cryptocurrency market, historical trends suggest that Bitcoin has yet to reach its ultimate peak, a sentiment echoed by numerous traders and analysts.

The Ongoing Bitcoin Bull Market Amidst Volatility

Historically, Bitcoin bull markets tend to peak 12 to 18 months following a halving event, the latest of which occurred in April 2024. This timeline suggests that Bitcoin’s upward trajectory may persist into late 2025, reinforcing the notion that current buying opportunities remain advantageous.

Nevertheless, market volatility is evident as of March 2025, with digital asset prices fluctuating significantly. Bitcoin’s price movements illustrate this turbulence: it dipped below $78,000 on February 28, surged close to $95,000 by March 2, fell under $83,000 on March 4, soared past $90,000 on March 5, and settled at $88,226 at press time.

In conclusion, while the cryptocurrency market remains unpredictable, Kiyosaki’s insights provide a strategic lens through which investors can navigate the complexities of Bitcoin investment. As the global financial landscape continues to evolve, staying informed and adapting to market trends will be crucial for investors aiming to maximize their returns.