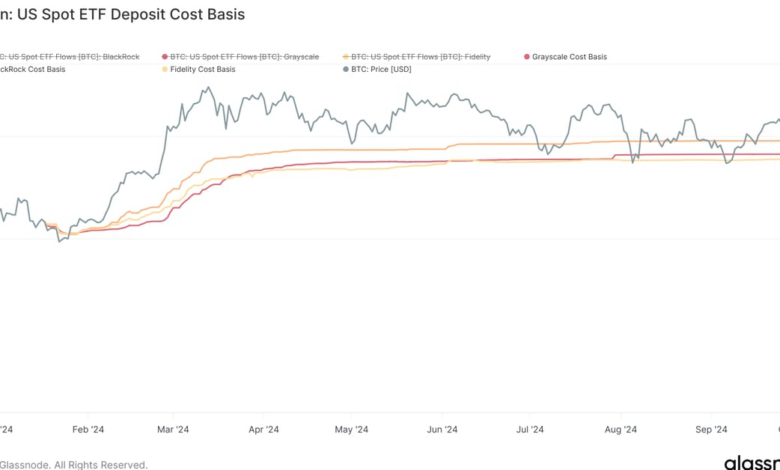

Glassnode, a leading blockchain data provider, has developed a unique methodology to determine the cost basis of bitcoin deposits to exchange-traded funds (ETFs) for the top three ETF issuers. This methodology offers valuable insights into the break-even point for ETF investors, helping them make more informed investment decisions.

The data provided by Glassnode reveals that investors in Fidelity’s FBTC ETF have a cost basis of $54,911, while investors in Grayscale’s bitcoin ETF have a cost basis of $55,943. On the other hand, investors in BlackRock’s bitcoin ETF have a cost basis of $59,120. These figures highlight the varying cost bases of investors in different bitcoin ETFs, shedding light on the potential profitability of their investments.

By analyzing the price stamping of bitcoin deposits to ETFs, Glassnode’s methodology offers a comprehensive understanding of the cost basis of ETF investors. This information can be crucial for investors looking to optimize their investment strategies and maximize their returns in the volatile cryptocurrency market.