Staying Ahead in Finance: The Urgent Call for U.S. Banks to Embrace Stablecoins

Our editorial team is committed to providing trusted content, meticulously reviewed by top industry professionals and seasoned editors. Ad Disclosure

Key Insights

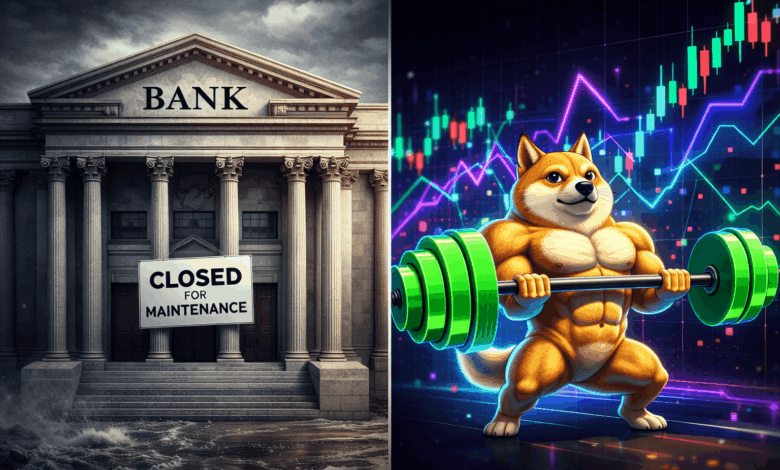

- 🚀 Senator Cynthia Lummis is urging American banks to integrate stablecoins without delay, cautioning that postponement for the CLARITY Act could result in a competitive disadvantage globally.

- 🚀 The absence of federal regulation is causing a divide: while institutions are at a standstill, retail investors are diving into volatile on-chain opportunities.

- 🚀 Maxi Doge is thriving in this high-risk environment with a viral narrative and has raised $4.5M, drawing considerable whale investment.

- 🚀 On-chain analytics show that savvy investors are allocating funds to speculative assets now, anticipating institutional liquidity will enter the market in the future.

Senator Lummis Advocates for Innovation in Banking

Senator Cynthia Lummis (R-WY) is not waiting for a nod from the legislative body. Acting as a pivotal link between Congress and the burgeoning digital asset industry, she has issued a stern warning to traditional banks: innovate or become obsolete. Highlighting the sluggish pace of federal regulation, particularly the dormant CLARITY Act, Lummis argues that banks cannot afford to wait for a perfect regulatory framework. Procrastination will only lead to missed opportunities.

Lummis’s statements expose a significant fault line within the U.S. financial framework. Despite the CLARITY Act’s intention to establish clear guidelines for stablecoin issuers, legislative gridlock has stalled banks. Lummis believes stablecoins represent a groundbreaking financial innovation capable of revolutionizing settlement processes that have remained unchanged since the 1970s.

The challenge extends beyond regulatory uncertainty; it’s about avoiding technological stagnation. Without quickly adopting blockchain for settlements, U.S. banks risk ceding their dominance to international players who are swiftly advancing with tech-driven solutions.

The Retail Shift to High-Volatility Assets like Maxi Doge

As regulators urge caution, retail investors are embracing a different mindset, characterized by bold conviction. This is where Maxi Doge ($MAXI) enters the scene. Exploiting the market’s appetite for volatility, the project is attracting considerable attention and investment. While Senator Lummis champions stability among bankers, $MAXI is appealing to traders looking for substantial returns.

Maxi Doge portrays a powerful canine figure embodying the ‘Leverage King Culture’—a humorous yet serious nod to the high-leverage mentality prevalent in aggressive crypto trading. The project’s philosophy is built on principles like ‘never skipping leg day’ and ‘never missing a pump,’ resonating with traders who perceive volatility as an opportunity rather than a risk.

The approach includes gamifying the holding process through exclusive trading competitions, encouraging retail traders to develop strong conviction akin to that of whale investors. In bullish markets, narratives can often outperform fundamental analysis. Maxi Doge’s ‘meme-first’ strategy, supported by a Maxi Fund treasury for liquidity, suggests the project is in it for the long haul rather than a quick profit.

Whales Show Interest as Maxi Doge Presale Surpasses $4.5M

Financial stakes speak louder than any legislative debate. While banks deliberate over stablecoins, on-chain data reveals that seasoned investors are positioning themselves strategically within speculative markets. According to Maxi Doge’s official presale information, the project has successfully raised over $4.5M. This indicates strong demand, possibly exacerbated by the existing market uncertainties.

Etherscan reveals that two major wallets have invested over $600K recently, with the largest transaction totaling $314K. Such substantial whale activity during a presale is atypical, as large investors usually wait for public liquidity events. With current investments occurring at a token price of $0.0002802, it appears high-net-worth individuals are anticipating a significant price adjustment once the token is publicly traded.

Technically, the setup is robust. Operating on Ethereum’s Proof-of-Stake network ensures compatibility with DeFi’s extensive liquidity pools. The smart contract maintains a strict control on supply, avoiding the inflationary pitfalls that often plague meme tokens. As the presale progresses, opportunities for entry at current valuations are dwindling.

Explore the opportunity to participate in the $MAXI presale today.

Disclaimer: This article is intended for informational purposes only and should not be considered financial advice. Cryptocurrencies, especially meme tokens, are highly volatile and carry significant risks. Always conduct your own research before investing.

Editorial Process

Our editorial process at Bitcoinist focuses on delivering content that is thoroughly researched, accurate, and unbiased. We adhere to stringent sourcing standards, and each article undergoes comprehensive review by our team of top technology experts and experienced editors. This ensures the integrity, relevance, and value of our content for our readers.