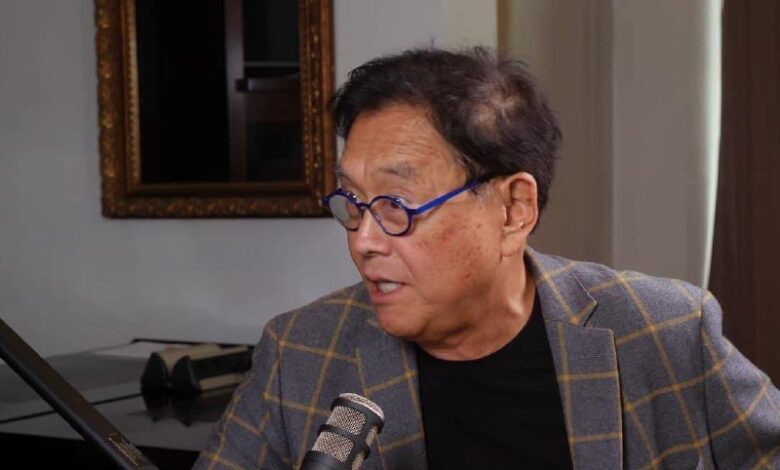

Robert Kiyosaki Warns of Potential Economic Downturn

Renowned American entrepreneur and financial educator Robert Kiyosaki has once again voiced his concerns over the global economic landscape. Known for his best-selling book, Rich Dad Poor Dad, Kiyosaki has taken to social media to issue a stark warning about a potential economic collapse reminiscent of the 1929 stock market crash and the ensuing Great Depression.

Causes for Concern: Rising U.S. Debt

At the forefront of Kiyosaki’s warning is the escalating national debt of the United States, which he identifies as a major threat to economic stability. He suggests that the excessive debt levels could lead to severe financial repercussions, urging individuals to consider alternative investment strategies.

Investment Recommendations: Gold, Silver, and Bitcoin

In his characteristic style, Kiyosaki advocates for a shift towards tangible assets such as gold and silver, alongside cryptocurrencies like Bitcoin (BTC). He emphasizes that these assets could serve as a hedge against potential market instability. His advice comes as part of a broader narrative, encouraging investors to prepare for financial turbulence by securing their wealth in more stable and reliable forms.

Exploring the Future of Bitcoin

In a recent development, Bitcoin experienced a dip below the crucial $119,000 level, signifying potential volatility in the cryptocurrency market. Despite this fluctuation, Kiyosaki remains confident in Bitcoin’s role as “digital gold,” positioning it as a counterbalance to the unpredictability of fiat currencies. This view aligns with the investment strategies of notable financial figures like Warren Buffett and Jim Rogers, who have reportedly shifted their focus to cash and precious metals.

Critique of Traditional Financial Instruments

Kiyosaki also expressed skepticism towards exchange-traded funds (ETFs), which he described as “paper assets” lacking the security of tangible holdings like precious metals. While he acknowledges the convenience ETFs offer to average investors, he cautions against relying solely on these instruments for financial security. His analogy, likening ETFs to a picture of a gun for personal defense, underscores his preference for more concrete investment options.

Conclusion: Emphasizing Tangible Value

In conclusion, Robert Kiyosaki’s recent remarks highlight his enduring skepticism towards conventional financial instruments. He champions a strategy that prioritizes accumulating tangible stores of value and non-fiat assets. As economic uncertainties loom, Kiyosaki’s insights serve as a reminder of the importance of diversifying investments to safeguard financial well-being.