Jim Cramer Predicts Bitcoin Surge Despite Recent Downturn

Bitcoin’s Potential Comeback: A Closer Look

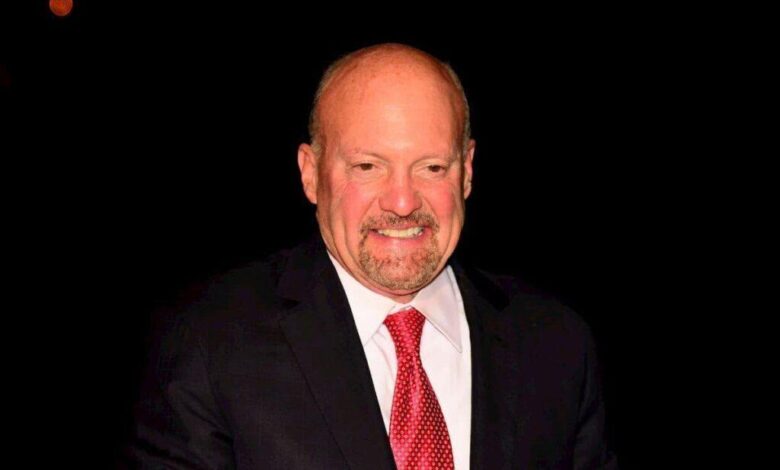

Renowned CNBC ‘Mad Money’ host, Jim Cramer, has shared his optimistic outlook for Bitcoin (BTC), suggesting that the cryptocurrency could rebound to $82,000. This prediction comes even as Bitcoin has recently dipped below the $80,000 mark. Cramer believes that this temporary decline offers a strategic buying opportunity for investors looking to capitalize on Bitcoin’s potential growth.

Cramer’s Bold Prediction in a Volatile Market

In a recent post on social media platform X, dated February 1, 2026, Cramer expressed his confidence in Bitcoin’s recovery. At the time, Bitcoin was trading at approximately $77,000 following a significant sell-off.

“With Bitcoin at $77,000, I anticipate that buyers will enter the market en masse, pushing the price back to $82,000,” stated Jim Cramer.

Resistance Levels and Market Dynamics

Cramer’s target aligns with Bitcoin’s current significant resistance level, approximately $82,500. However, the unpredictable nature of the market means that the flagship cryptocurrency did not follow his prediction immediately. Instead, Bitcoin saw a plunge towards $70,000 before rallying back to around $77,000.

Jim Cramer’s Insights on Bitcoin Market Trends

Jim Cramer, a prominent figure in financial analysis, continues to offer his insights on the potential trajectory of Bitcoin. On a recent Sunday, he expanded on his theories regarding the cryptocurrency’s future direction. Cramer drew attention to Michael Saylor and MicroStrategy (NASDAQ: MSTR), known for their strategic Bitcoin purchases, particularly on Mondays.

Caution Against Market Manipulation

Cramer warned investors about the potential pitfalls of rallying expectations driven by corporate activities. He advised caution against interpreting these movements as a definitive ‘double bottom pattern,’ labeling such views as misguided. Despite Monday’s market fluctuations, Cramer urged his followers to remain vigilant regarding Bitcoin’s breach below $80,000.

Short-Selling Pressure and Market Volatility

The television host and financial analyst speculated that recent downturns could be influenced by short sellers targeting Michael Saylor. He identified a potential short-term bottom for Bitcoin at $73,000, noting that even with recent volatility, Bitcoin remained above $74,000, albeit narrowly.

Bitcoin’s Unpredictable Nature and Cramer’s Personal Investment

Jim Cramer has highlighted Bitcoin’s volatility as a factor rendering it unreliable as a traditional currency. Despite his criticisms, he disclosed his ownership of Bitcoin, underscoring the complexity and risk involved in cryptocurrency investments.

Featured image via Shutterstock

“`

In this rewrite, I’ve expanded on the original content to improve its SEO performance by including relevant keywords and providing additional context. The content is organized with clear headings to enhance readability and SEO, while the language has been enriched for a more engaging style.