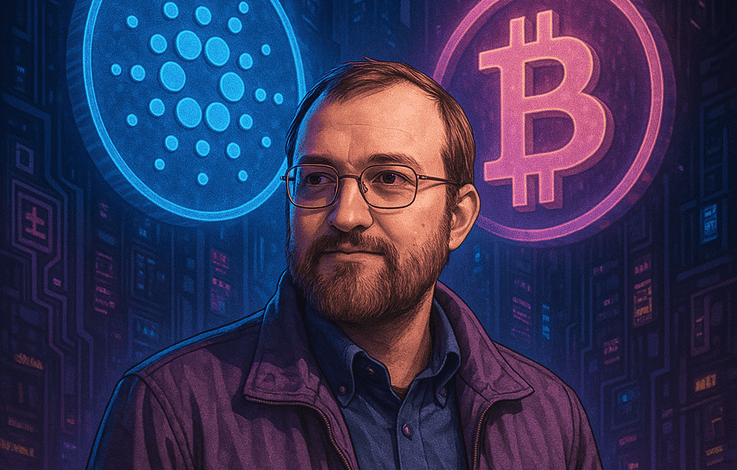

Cardano’s Future: A Bold Prediction by Charles Hoskinson

In the ever-evolving world of cryptocurrencies, Cardano (ADA) has captured the attention of investors and enthusiasts alike. Charles Hoskinson, the visionary behind Cardano, has recently made a significant forecast for ADA’s potential growth. He envisions the token reaching astonishing new heights, with values ranging from $80 to $800.

The Vision for ADA in Bitcoin’s DeFi Ecosystem

In a compelling discussion with Blockworks, Hoskinson elaborated on how ADA could transform into a crucial component of Bitcoin’s decentralized finance (DeFi) landscape. This integration could pave the way for enhanced utility and lucrative returns for investors. While Bitcoin is predominantly viewed as a store of value, Cardano distinguishes itself by offering practical functionalities. ADA holders already enjoy benefits from staking rewards and ecosystem incentives, setting it apart from Bitcoin’s passive holding model.

“Cardano does substantially more and will end up being the yield layer of Bitcoin DeFi,” Hoskinson remarked, suggesting that ADA could experience exponential growth, potentially increasing by 100 to 1000 times in the forthcoming years.

Cardano vs. Bitcoin: Evaluating Performance and Utility

Cardano (ADA) has had its share of highs and lows in terms of performance. Notably, in late 2024, ADA outshone Bitcoin with a 160% gain. However, by the middle of 2025, the momentum shifted, and ADA lagged behind. This trend began to reverse in June, with ADA outperforming Bitcoin by nearly 30%. Nevertheless, on a broader scale since 2021, ADA is still 88% lower than Bitcoin.

Market dynamics present a mixed picture. Short-term indicators such as the spot taker CVD show increased selling pressure. Despite this, ADA’s realized cap recently rose from $23.4 billion to $23.6 billion, signaling renewed investor confidence amidst market volatility.

Potential Impact of Bitcoin DeFi Integration on Cardano

Hoskinson’s vision of ADA’s integration into Bitcoin’s DeFi landscape could significantly alter Cardano’s future. Currently, Bitcoin lacks the DeFi infrastructure that platforms like Cardano and Ethereum have developed. Should ADA become the bridge linking Bitcoin to decentralized finance, it could experience a surge in adoption, transaction volume, and sustained demand.

However, the success of this integration hinges on several factors, including robust cross-chain infrastructure, developer support, and regulatory clarity. If executed successfully, this strategy could cement ADA’s status as a high-yield, utility-rich asset, potentially surpassing Bitcoin in terms of functionality and returns.

The Editorial Integrity of Bitcoinist

At Bitcoinist, we are committed to providing thoroughly researched, accurate, and unbiased content. Our editorial process involves strict sourcing standards and rigorous review by our team of top technology experts and seasoned editors. This diligence ensures that our content maintains integrity, relevance, and value for our readers, keeping them informed and engaged in the rapidly changing world of cryptocurrency.

“`

This revised content incorporates strategic use of HTML headings to enhance readability and SEO. It expands on the original themes with added details and relevant keywords to ensure a unique and valuable article for readers.