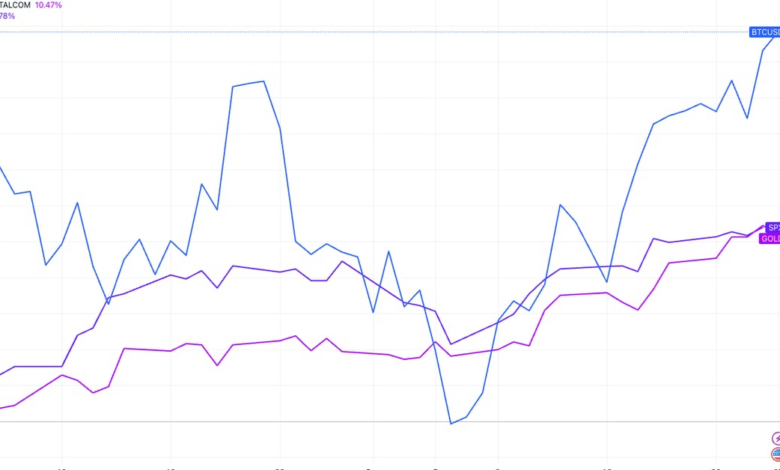

Bitcoin’s high volatility is often seen as a double-edged sword in the world of investing. On one hand, it can lead to significant gains for those who time their trades correctly. On the other hand, it can be perceived as a “risky” asset, which raises the question of whether it is a “risk-on” or “risk-off” asset.

Despite its volatility, some argue that bitcoin could be considered a flight-to-safety option. This is due to the fact that it is scarce, non-sovereign, and decentralized. In times of economic uncertainty, investors may turn to assets like bitcoin as a way to protect their wealth from inflation and government interference.

In a recent report, investment firm BlackRock highlighted the potential long-term adoption of bitcoin. According to BlackRock, global instability could drive more investors towards alternative assets like bitcoin. As traditional markets become increasingly volatile, bitcoin’s status as a decentralized and censorship-resistant asset may become more attractive to investors looking to diversify their portfolios.