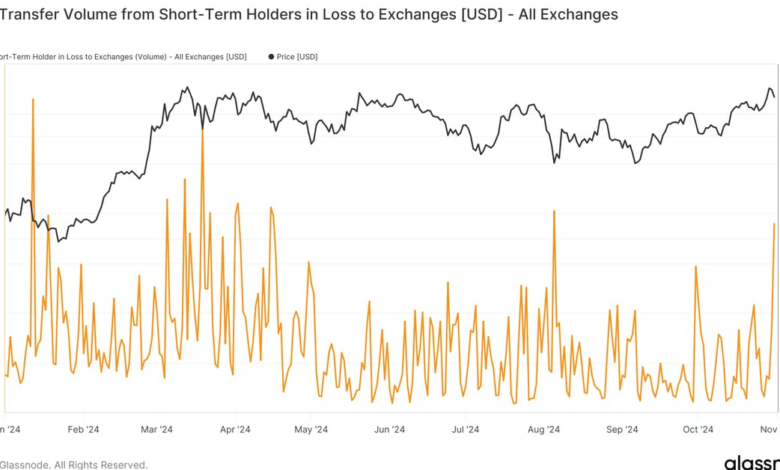

The recent panic selling in the Bitcoin market has reached its highest level since August 5th, reminiscent of the yen carry trade unwind. Short-term holders, those who have held Bitcoin for less than 155 days, tend to panic and sell when the price drops, and buy when there is euphoria or greed in the market. On Thursday, these short-term holders sent over 54,000 BTC to exchanges, marking the highest amount since March 27th.

This surge in panic selling indicates a high level of fear and uncertainty among short-term Bitcoin investors. It suggests that these investors are quick to react to market movements, selling off their holdings when prices decline, and potentially exacerbating downward price pressure.

While panic selling can lead to short-term price drops, it also presents buying opportunities for long-term investors who believe in the fundamental value of Bitcoin. By remaining calm and focused on the long-term potential of the cryptocurrency, these investors can take advantage of market fluctuations and accumulate more Bitcoin at lower prices.