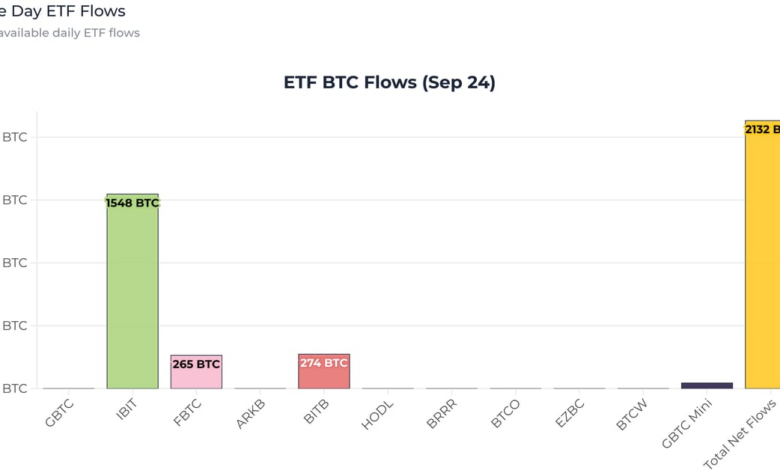

Recent data from Farside Investors reveals that bitcoin exchange-traded funds (ETFs) received a total inflow of $136.0 million on Sept. 24. The standout performer was BlackRock’s IBIT ETF, which saw a significant influx of $98.9 million, its largest since Aug. 26. This pushes IBIT’s overall net inflows above $21 billion, solidifying its position as the top player in the market. Other key players included Fidelity’s FBTC, attracting $16.8 million, and Bitwise’s BITB, with $17.4 million in inflows.

Investors are showing continued interest in bitcoin ETFs, with significant capital flowing into these investment vehicles. BlackRock’s IBIT ETF, in particular, has been a standout performer, attracting substantial inflows and maintaining its dominant position in the market. With the cryptocurrency market continuing to evolve, ETFs offer investors a convenient way to gain exposure to bitcoin and other digital assets.