Ripple CTO Predicts Blockchain’s Role in Transforming Finance

Introduction to Ripple’s Onchain Economy Series

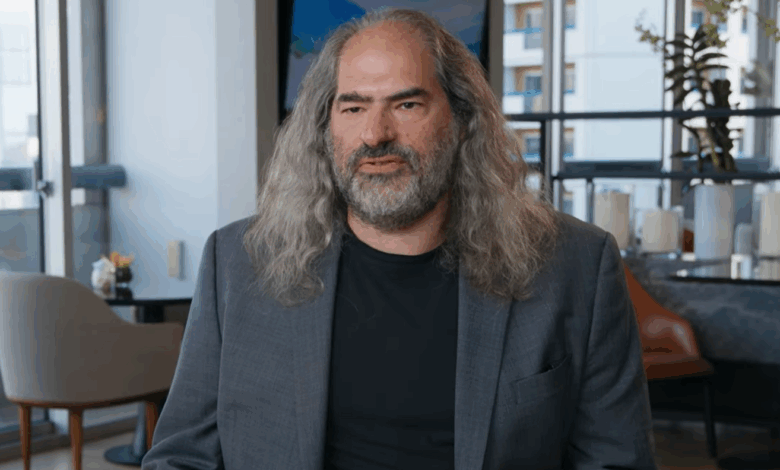

Ripple has initiated an intriguing exploration of the future of finance through its new video series titled “Onchain Economy.” In its inaugural episode, released on September 25, the spotlight is on David Schwartz, Ripple’s Chief Technology Officer, as he discusses the increasing inevitability of blockchain technology being embraced by major internet corporations. He emphasizes how this decentralized infrastructure is poised to revolutionize financial systems at a crucial juncture.

The Shift from Traditional Finance to Blockchain

Schwartz articulates a compelling vision of how technology, irrespective of blockchain, is set to redefine the financial landscape. He identifies the inadequacies of current financial systems in catering to the evolving needs of tech giants such as Amazon and Uber. According to Schwartz, blockchain technologies are perfectly timed to fill those gaps, offering solutions like programmable money, seamless settlements, and adaptable workflows that are vital for modern, software-driven enterprises.

Beyond Speculation: DeFi’s Practical Applications

In his discourse, Schwartz distances his perspective from the speculative aspects often associated with cryptocurrencies. He emphasizes that decentralized finance (DeFi) should not merely be about high-risk, high-reward scenarios or digital collectibles. Instead, DeFi, which encompasses smart contracts and their supporting infrastructure, is positioned to significantly disrupt traditional finance (TradFi) as it meets real-world financial demands with secure and compliant solutions.

Navigating Decentralization and Institutional Needs

The balance between decentralization and institutional adoption forms the core of Schwartz’s argument. He asserts that public blockchains offer the neutrality that institutions seek, allowing for multi-party collaboration without centralized control. This neutrality is seen not as a liability but as an essential feature that can enhance institutional operations.

Ripple’s Strategic Positioning and XRPL’s Potential

Ripple is strategically positioning its XRP Ledger (XRPL) as a robust platform for institutional on-chain finance, encompassing stablecoin transactions and tokenized assets. A recent analysis highlighted XRPL’s impressive monthly stablecoin volume exceeding $1 billion, positioning it as a leader in real-world asset activity. Ripple’s roadmap focuses on integrating verifiable credentials, asset control mechanisms, and a protocol-level lending layer, underscoring the potential of neutral public ledgers to meet institutional demands.

Innovations in Decentralized Exchanges

Earlier this year, Ripple proposed a novel concept for a permissioned decentralized exchange (DEX) linked to XRPL’s native exchange, aiming to harmonize KYC/AML requirements with the liquidity and transparency of a public order book. This design showcases Ripple’s vision of regulated entities operating within a decentralized framework, avoiding liquidity fragmentation across private markets.

Current Market Performance

As of the latest update, XRP is trading at $2.76, maintaining its position above the 0.618 Fibonacci level, reflecting its resilience in the current market landscape.

Conclusion

Ripple’s ongoing efforts to integrate blockchain into mainstream finance are reflective of a broader industry trend towards decentralization. By aligning blockchain capabilities with institutional requirements, Ripple aims to lead the charge in transforming traditional finance into a more efficient, transparent, and accessible system.

Editorial Quality and Integrity

Editorial Process: At Bitcoinist, we are committed to delivering meticulously researched, accurate, and unbiased content. Our rigorous editorial process involves strict sourcing standards and comprehensive reviews by our team of expert editors and technology specialists. This dedication ensures the high quality and relevance of our content for our readers.