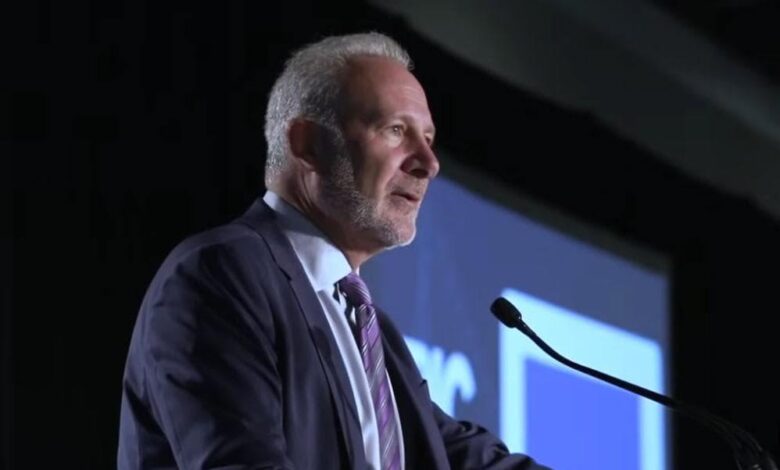

Peter Schiff’s Bearish Bitcoin Forecast: An Analysis

Bitcoin is once again under the scrutiny of vocal critic Peter Schiff, who has issued a sharp bearish forecast. As the cryptocurrency’s price consolidates around the mid-$60,000 level, Schiff argues that bearish forces are preparing to challenge the crucial $50,000 long-term support level.

The Potential Downward Momentum

According to Schiff, if Bitcoin breaches this $50,000 threshold, it could trigger a downward momentum that might drag the cryptocurrency towards the $20,000 mark. This projection was shared by Schiff in a post on X on February 19.

A Historical Perspective

Schiff suggests that if Bitcoin falls below $50,000, which he considers likely, it could test $20,000, marking a significant 84% decline from its all-time high. While Bitcoin has experienced such drops in the past, Schiff points out that the current scenario involves unprecedented levels of hype, leverage, institutional ownership, and market capitalization. He urges investors to sell Bitcoin now, emphasizing the risks involved.

Bitcoin’s Current Market Status

Following its sharp decline from above $70,000, Bitcoin has entered a consolidation phase, struggling to make a decisive move. As of the latest updates, Bitcoin is trading at $68,210, showing a 2% increase over the past 24 hours.

Focus on the $50K Support Level

The $50,000 zone has long been regarded as a critical structural support level during broader market corrections. Schiff argues that if this level is breached, especially with the price already below $55,000, there could be an increase in selling pressure. This could lead to cascading liquidations and a decline in investor confidence.

Revised Projections and Broader Outlook

Earlier this month, Schiff projected an even steeper decline, suggesting initial support could emerge near $10,000. However, he later adjusted this prediction to $20,000. Despite this revision, his overall bearish outlook remains unchanged.

Understanding Schiff’s Criticism of Bitcoin

Peter Schiff, a noted gold enthusiast, has been a critic of Bitcoin since 2013, a time when the asset was trading below $500. He consistently frames Bitcoin as a speculative asset rather than a sustainable store of value, often comparing it unfavorably to gold. Even as Bitcoin has delivered significant gains over multiple cycles, Schiff remains skeptical.

Investor Perception and Market Dynamics

In his latest comments, Schiff described some investors as “dumb enough” to buy Bitcoin, while others succumbed to the fear of missing out. Proponents of Bitcoin argue that such rhetoric overlooks the asset’s long-term growth potential and resilience through repeated market corrections.

Bitcoin’s Market History and Bearish Predictions

Historically, Bitcoin has endured several corrections exceeding 50%, only to recover and establish new highs. Major support levels often attract liquidity during downturns, although decisive breaks can lead to increased volatility.

Debate Among Financial Experts

Schiff’s predictions frequently spark debates in financial circles. While his bearish outlook garners attention during market corrections, Bitcoin’s history of recovery challenges the narrative of a persistent collapse.

“`

By structuring the content with descriptive headings and enriching the language with relevant keywords, this rewrite aims to improve SEO compatibility while providing valuable insights into the ongoing Bitcoin debate.