Insightful Analysis: Navigating the Shifts in Bitcoin Investment Landscape

Our expert-reviewed editorial content offers a comprehensive perspective on current market developments. Please note our advertisement disclosure for transparency.

Essential Insights:

- ➡️ U.S. spot Bitcoin ETFs experienced outflows amounting to $434 million as BTC prices continued to decline, prompting institutional investors to reduce risk.

- ➡️ Investors are increasingly shifting from passive ‘paper Bitcoin’ products towards on-chain protocols that provide yield and enhanced programmability.

- ➡️ Bitcoin Hyper is seizing this opportunity by incorporating the Solana Virtual Machine (SVM) to introduce swift smart contracts to the Bitcoin network.

- ➡️ Despite market challenges, savvy investors have committed over $31M to the $HYPER presale, aiming for early participation in Bitcoin’s infrastructural evolution.

Recent statistics underscore a concerning trend: Bitcoin is precariously close to the significant psychological support level of $60,000, leading institutional investors to reconsider their positions. Recent data highlights a significant withdrawal from U.S. spot Bitcoin ETFs, with outflows reaching $434 million on Thursday alone. When combined with the rest of the week’s figures, losses exceed $1 billion.

Leading the charge in this retreat are Fidelity’s FBTC and Grayscale’s GBTC. This signals a rapid de-risking by traditional finance players amid ongoing macroeconomic uncertainties. This movement highlights the inherent vulnerability of ‘paper Bitcoin.’ When price movements stall, ETF holders—who incur management fees without earning yield—find little motivation to maintain their investments. Consequently, there’s a noticeable shift as capital moves away from passive, fee-charged products in search of on-chain utility.

Let’s be candid: Bitcoin has historically faced challenges due to its stagnation. It simply resides in wallets or custodial vaults, without generating yield or easily executing smart contracts. Additionally, its relative slowness compared to modern blockchain networks is a well-known issue.

As ETFs witness withdrawals, a distinct divergence is emerging. While retail investors panic sell and institutions hedge, discerning capital is venturing further into infrastructure that addresses Bitcoin’s utility shortcomings. The market is now favoring protocols that activate dormant BTC rather than merely storing it.

This shift in sentiment creates a substantial opportunity for Bitcoin Hyper ($HYPER), a project committed to bridging the gap between Bitcoin’s security and the high-speed capabilities of decentralized finance.

Unlocking Dormant Bitcoin Capital with High-Performance Layer 2 Solutions

ETF outflows reveal a critical issue in the current ecosystem: the lack of programmability. Investors recognize that holding an asset excluded from DeFi represents a significant opportunity cost. Bitcoin Hyper ($HYPER) addresses this by positioning itself as the first Bitcoin Layer 2 to incorporate the Solana Virtual Machine (SVM). This is a technological advancement, not mere marketing rhetoric. By utilizing the SVM, the protocol aims to achieve transaction speeds comparable to Solana, introducing sub-second finality to the Bitcoin network.

What many analyses overlook is the modular architecture. Bitcoin Hyper leverages Bitcoin Layer 1 for settlement and security while delegating execution to a real-time SVM Layer 2. This enables high-speed transactions in wrapped BTC and complex DeFi applications, including swaps, lending, and gaming, coded in Rust. It effectively resolves the blockchain trilemma by preserving Bitcoin’s trust layer while eliminating its latency.

For developers, this opens new possibilities for creating Ethereum-style decentralized applications (dApps) on Bitcoin without the congestion or high fees associated with the main chain. The project utilizes a Decentralized Canonical Bridge for BTC transfers and a single trusted sequencer with periodic Layer 1 state anchoring. This ensures that while execution is swift, the ultimate truth remains on the Bitcoin network. For investors weary of watching their BTC remain idle in an ETF as the market declines, the prospect of staking APY presents an enticing alternative to passive holding.

Whales Pivot to Bitcoin Hyper Amidst a $31M Presale Surge

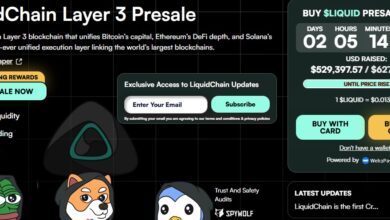

As the broader market faces challenges, on-chain data indicates that astute investors are accumulating $HYPER. According to the official presale page, Bitcoin Hyper has defied the bearish trend, raising an impressive $31.2 million thus far. The token is currently priced at $0.0136752, attracting significant interest amid the turmoil in major crypto indices.

This divergence—ETF selling contrasted with presale buying—suggests that capital isn’t exiting the crypto space entirely. It’s merely transitioning from oversaturated assets to early-stage infrastructure opportunities. The tokenomics structure rewards early conviction. Bitcoin Hyper offers immediate staking following the Token Generation Event (TGE), though presale stakers face a 7-day vesting period to deter immediate sell-offs. This lock-up aligns with the project’s focus on long-term governance.

As Bitcoin grapples with holding the $60K benchmark, the risk-reward ratio appears to be shifting towards protocols that provide yield and utility rather than mere price speculation.

Disclaimer: This article is intended for informational purposes only and does not constitute financial advice. Cryptocurrencies, including presales and Layer 2 tokens, are highly volatile and risky investments. Always conduct your own research before making investment decisions.

Editorial Excellence

Our editorial process at Bitcoinist is dedicated to delivering thoroughly researched, accurate, and unbiased content. We adhere to stringent sourcing standards, and each page undergoes meticulous review by our team of leading technology experts and experienced editors. This rigorous process ensures the integrity, relevance, and value of our content for our readers.