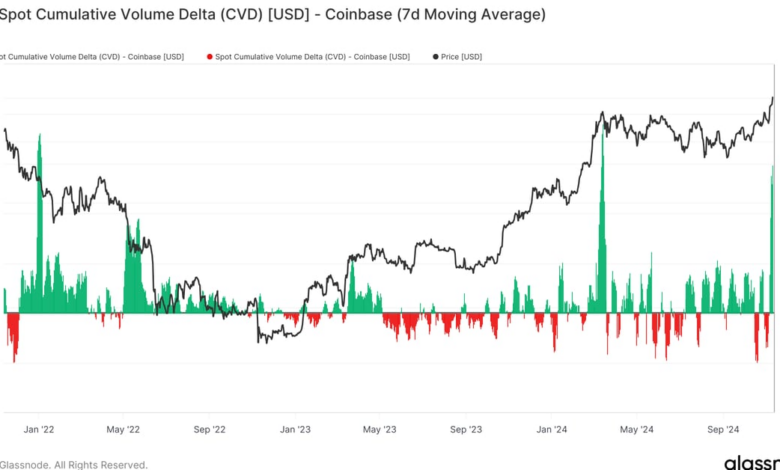

Looking at the data from the past three years, a pattern emerges when it comes to Coinbase CVD (Coinbase Volume Distribution) spikes and their correlation with local highs and lows in the price of Bitcoin. For example, in March, one of the highest CVD levels was recorded as Bitcoin surged to a then-record high above $73,000.

Interestingly, there were also notable spikes in CVD near cycle lows, such as during the Luna and FTX collapse in 2022. This suggests that smart money may have been buying near the bottom, while others were buying near the top of the market.

This pattern highlights the importance of paying attention to Coinbase CVD levels as a potential indicator of market sentiment and price movements in the world of cryptocurrency trading.