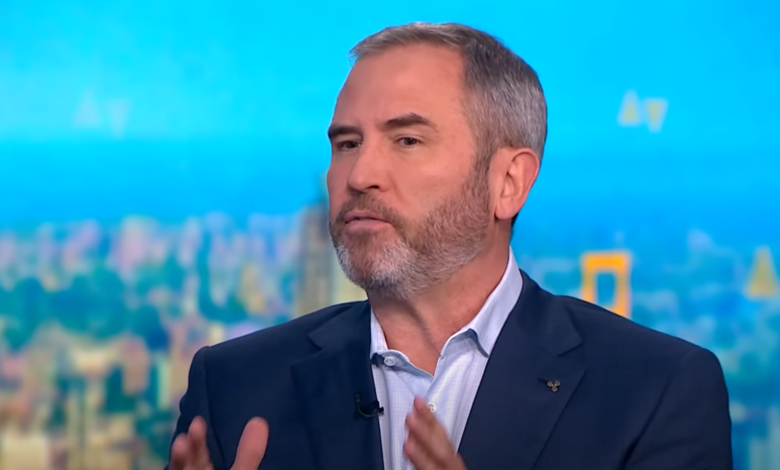

Ripple CEO Brad Garlinghouse on SEC Lawsuit, IPO Possibilities, and XRP’s Role in Crypto

In a revealing discussion with Bloomberg, Ripple’s CEO Brad Garlinghouse shared insights into the resolution of Ripple’s legal conflict with the U.S. Securities and Exchange Commission (SEC). He also shed light on Ripple’s plans moving forward, encompassing everything from potential IPOs to XRP’s involvement in the evolving U.S. crypto landscape.

Resolution of the Ripple and SEC Legal Conflict

The legal proceedings between Ripple and the SEC, which began in December 2020, have reached a pivotal conclusion, according to Garlinghouse. He emphasized that the SEC has opted to abandon its appeal against a previous court ruling affirming that “XRP in and of itself was not a security.”

“We achieved significant victories in the summer of 2023. Judge Torres ruled that XRP, by itself, was not a security. The SEC had filed an appeal about eight months back, but now they’ve agreed to dismiss it.”

Despite a pending cross-appeal from Ripple, Garlinghouse conveyed that the company now holds greater control over its legal strategy. The ongoing discussions primarily revolve around a $125 million sum held in escrow, connected to a penalty imposed for XRP sales to certain institutional investors. “We are keen to reclaim that amount, and it’s currently a topic of negotiation,” he remarked.

Garlinghouse criticized the previous SEC Chair Gary Gensler’s approach to crypto oversight, describing it as an overreach of power aimed at extending the SEC’s jurisdiction. He stressed that Ripple’s stance is rooted in the belief that “no investors suffered financial losses” due to the contested XRP sales.

XRP’s Prospects in the U.S. Crypto Stockpile

Garlinghouse hinted at XRP’s potential inclusion in a new federal initiative. Although the Trump administration’s executive order, which created a Strategic Bitcoin Reserve and a distinct Crypto Stockpile, did not specifically mention XRP, Garlinghouse argued that XRP is a suitable candidate.

“It appears there will be a Bitcoin strategic reserve along with a crypto stockpile for other digital currencies, and I anticipate XRP will be part of that. My understanding is that seized cryptocurrencies, including XRP, will contribute to this stockpile, complementing the Bitcoin reserve.”

Garlinghouse expressed optimism regarding the launch of spot XRP exchange-traded funds (ETFs), noting that several proposals are under SEC review from prominent asset managers. “There are 11 proposals awaiting approval, from firms like Bitwise to Franklin Templeton. We expect them to become available later this year,” he stated.

He further highlighted that, despite withdrawals from some crypto-linked products, investments in XRP-based offerings have persisted, counteracting any “false negative pressure” experienced during the SEC proceedings.

Potential IPO and Acquisition Strategies

There has been ongoing speculation about Ripple’s potential public offering. With regulatory clarity improving, Garlinghouse acknowledged the potential for an initial public offering (IPO), although he clarified it is not the company’s primary focus. “An IPO is not a pressing priority for us. Most companies pursue it to raise capital, but we’ve been fortunate to grow organically without it,” he explained.

Instead, Garlinghouse emphasized acquisitions as a more immediate goal for Ripple. He predicted industry-wide “consolidation” as the U.S. crypto market transitions from regulatory challenges to potential opportunities. “We’re exploring blockchain infrastructure companies. This year will likely see consolidation, and we’re eager to play a role in it,” he added.

Garlinghouse also highlighted Ripple’s focus on stablecoins, particularly their own stablecoin, RLUSD, launched late last year. The stablecoin already contributes significantly to the $230 billion total stablecoin supply, with expectations for substantial growth in the coming years.

“RLUSD launched at the end of last year, outperforming our forecasts. By year’s end, we aim for RLUSD to rank among the top five stablecoins in the market.”

He also noted increased engagement in stablecoin applications, such as Robinhood’s shift towards 24-hour trading. With stablecoin legislation progressing through Congress, Garlinghouse anticipates a significant expansion of the market this year.

At the time of writing, XRP is trading at $2.44.

Commitment to Editorial Excellence

Our editorial process at Bitcoinist is dedicated to delivering meticulously researched, accurate, and unbiased content. We adhere to rigorous sourcing standards, and every page undergoes thorough review by our team of top technology experts and experienced editors. This ensures our content’s integrity, relevance, and value for our readers.