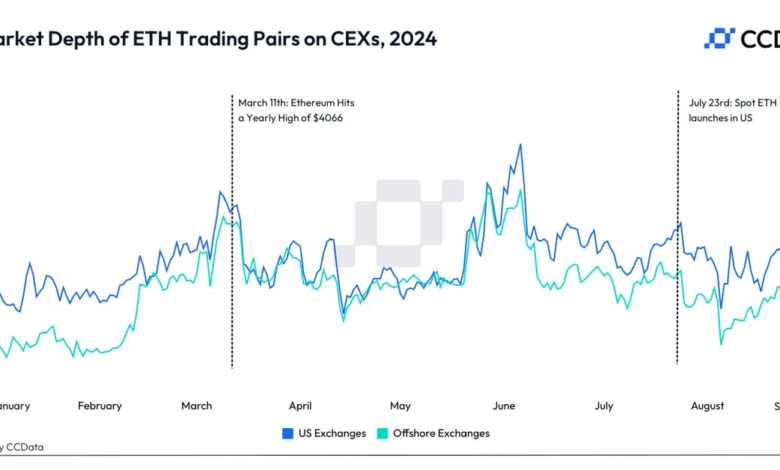

According to Jacob Joseph, a research analyst at CCData, the market liquidity for ETH pairs on centralized exchanges has decreased significantly since its peak in June. While the liquidity is still higher than at the beginning of the year, it has dropped by almost 45%.

Joseph attributes this decline in liquidity to the current poor market conditions and seasonal effects typically seen in the summer, which often lead to lower trading activity. As a result, traders may find it more challenging to execute large orders or find suitable counterparties for their trades.

Despite the decrease in liquidity, Ethereum continues to be one of the most popular cryptocurrencies in the market, with a strong community and developer support. As the market conditions improve and trading activity picks up, it is possible that liquidity for ETH pairs on centralized exchanges will rebound.