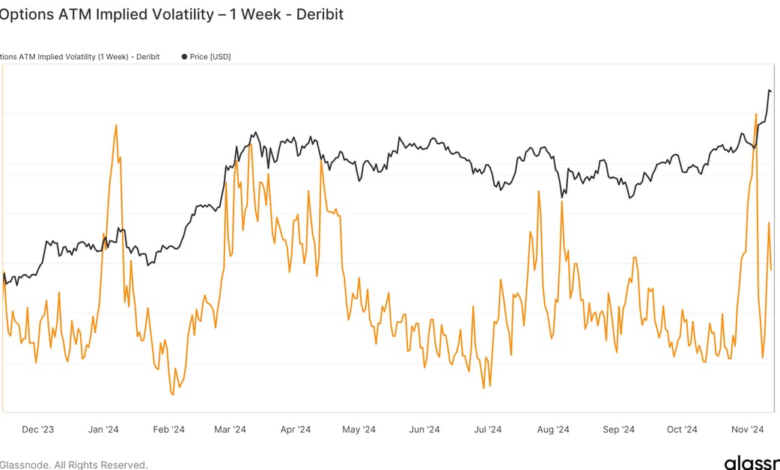

One of the major concerns in the current economic climate is the fear that inflation will not be successfully managed. This concern is particularly evident when looking at U.S. yields, which have been steadily increasing since the Federal Reserve initiated a series of rate cuts. The first rate cut, a significant 50 basis points (bps) reduction, was quickly followed by another 25 bps cut. Since these rate cuts began on September 16, the U.S. 10-year Treasury yield has risen from 3.6% to 4.4%.

Furthermore, the U.S. 3-month Treasury yield is currently trading at 4.6%, closely tracking the effective federal funds rate. This suggests that the market anticipates no more than an additional 25 bps of rate cuts in the next three months. The current target rate set by the Federal Reserve is 450-475 bps.

These developments in U.S. yields indicate a growing concern about the potential impact of inflation on the economy. Investors and economists are closely monitoring these trends to gauge the future direction of interest rates and inflationary pressures.