Ripple’s Resurgence: A New Era in Digital Finance

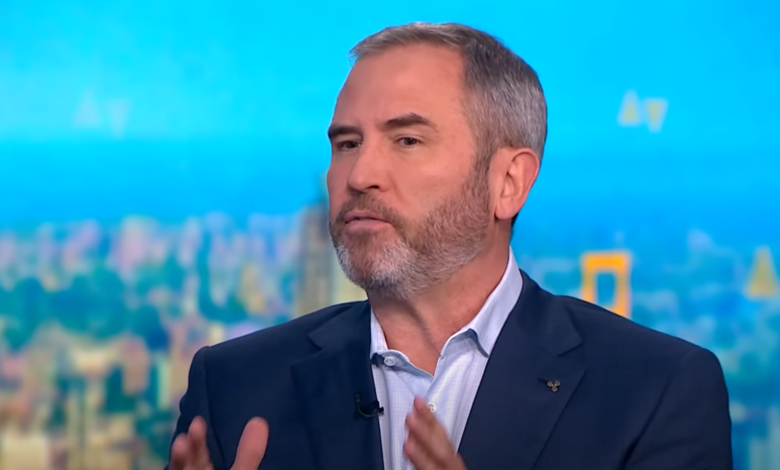

In a recent discussion with FOX Business, Ripple’s CEO, Brad Garlinghouse, revealed that financial institutions, notably banks, are showing a heightened interest in Ripple and its digital asset, XRP. This comes in the wake of the US Securities and Exchange Commission’s (SEC) decision to conclude its inquiry into Ripple, marking a pivotal moment not only for the company but also for the broader cryptocurrency landscape in the United States.

Ripple CEO: The Awakening of the US Market

Reflecting on Ripple’s extensive legal entanglement with the SEC, Garlinghouse described the resolution as a triumph for the entire industry. He stated, “Ripple was among the pioneering crypto firms to be targeted by the SEC. From the outset, we believed that the SEC was not only misaligned with legal principles but also with historical trends. Although the journey extended longer than anticipated, with legal expenses surpassing $150 million, we are elated with the favorable outcome. This resolution empowers us to fully engage with the US market.”

Despite initial obstacles in the US due to regulatory uncertainties, Ripple, traditionally focused on facilitating cross-border payments, is now witnessing a shift. Garlinghouse noted that a significant portion of Ripple’s clientele, about 95%, comprises non-US financial institutions, including major players like HSBC and BBVA. However, the end of the SEC scrutiny is spurring increased domestic involvement.

Innovative Technologies Reshape Financial Infrastructure

Garlinghouse highlighted a surge in US deals post the election, surpassing those in the preceding months. He emphasized the transformative potential of these technologies, predicting their influence over the next decade or two in revamping the US financial framework, spanning payments to real estate and securities transactions. “The magnitude of this change is often underestimated,” he remarked.

The renewed interest is also linked to executive orders from a pro-crypto agenda, including initiatives to bolster US leadership in digital financial tech and create a strategic reserve of digital assets. At a recent Digital Asset Summit, it was noted that the adoption of dollar-backed stablecoins could fuel US economic dominance.

A New Dawn for Financial Institutions

Garlinghouse described the shift as a significant “unlock” for US banks, which had previously been wary of engaging with crypto technologies. He noted, “Financial institutions are now more open to embracing these innovations, marking a significant shift not just for Ripple, but for the entire industry.”

Regulatory Framework and Legislative Efforts

The conversation also touched upon the ongoing legislative discussions in Washington. Garlinghouse commended efforts by lawmakers to provide clarity on digital asset regulations, emphasizing the need for legislative backing to solidify executive efforts. He referred to progress on a stablecoin and market structure bill, which could offer the clarity long sought by the industry.

Reiterating Ripple’s legal victory, Garlinghouse noted that XRP was recognized as a commodity, contrary to the SEC’s stance, thus bolstering Ripple’s position on both domestic and international fronts.

The Future of Global Payment Systems

With legacy systems like SWIFT still handling trillions, Garlinghouse sees immense potential for modernization. He envisions a significant opportunity to upgrade these outdated systems, stating, “The chance to modernize is enormous, and the US market is now poised to capitalize on this.”

As Ripple progresses, it anticipates that regulatory clarity will expedite the integration of blockchain into mainstream finance, enhancing services from payments to securities settlements. Garlinghouse concluded, “This innovation will foster job creation, spur further innovation, and encourage capital formation within the US.”

At the time of this report, XRP was valued at $2.4295.

Editorial Integrity and Process

Our editorial team at Bitcoinist is committed to delivering content that is thoroughly researched, accurate, and unbiased. We adhere to strict sourcing standards, ensuring each article undergoes rigorous review by our team of leading technology experts and seasoned editors. This meticulous process guarantees the reliability, relevance, and value of our content for our audience.