Figure, a fintech company offering lines of credit backed by home equity, has been a major player in the on-chain private credit market. Despite this, other companies in the sector have also seen growth in active loans.

Centrifuge, Maple, and Goldfinch are among the companies driving this growth, providing alternatives to traditional lending institutions. These companies are offering innovative solutions for borrowers looking for access to credit without going through traditional financial channels.

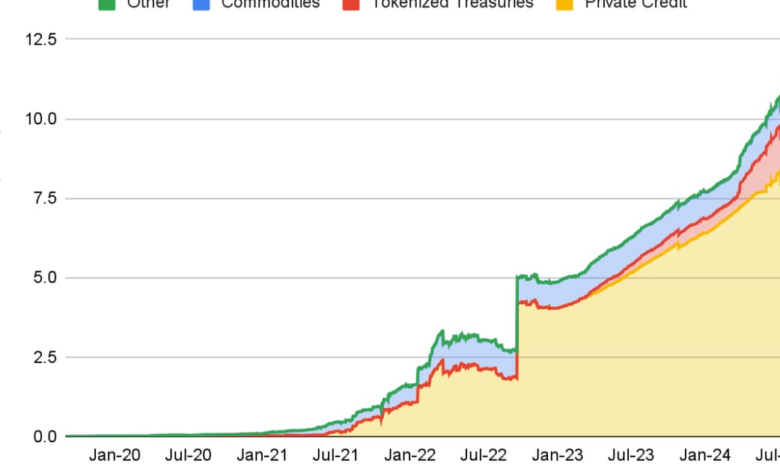

The on-chain private credit market is expanding, with more players entering the space and offering different lending options. This growth is a positive sign for the industry, as it shows that there is a demand for alternative lending solutions outside of the traditional banking system.

Overall, the on-chain private credit market is seeing increased activity and interest from borrowers and investors alike. With companies like Figure leading the way and others following suit, this sector is poised for further growth in the future.