In the rapidly evolving world of digital currencies, understanding altcoins is essential. Unlike Bitcoin, which is the pioneer, altcoins offer a variety of features that make them uniquely appealing. In this ultimate guide to Crypto Coin, we will delve into what makes altcoins special, explore some of the most popular ones, and provide valuable tips and strategies for investing. While investing in altcoins can be rewarding, it also comes with its own set of risks. Thus, it is crucial to be well-informed before diving into the altcoin market.

Understanding Altcoins: A Brief Introduction

When discussing the vast world of Crypto Coin, one cannot overlook the importance of altcoins. But what exactly are altcoins? In essence, altcoins are alternative cryptocurrencies launched after Bitcoin’s success. They provide various uses and features, enhancing or challenging Bitcoin’s existing framework.

Key Characteristics of Altcoins:

- Diverse Use Cases: Altcoins often serve specific purposes not addressed by Bitcoin. These can range from smart contracts to decentralized applications.

- Technological Innovations: Some altcoins offer technological improvements such as faster transactions or enhanced security.

- Market Significance: A few altcoins have gained significant market capitalization, influencing the broader Crypto Coin landscape.

| Aspect | Bitcoin | Altcoins |

|---|---|---|

| Primary Use Case | Digital Currency | Varies by Altcoin |

| Transaction Speed | Moderate | Can be faster |

| Technological Scope | Limited | Broad and varied |

Altcoins introduce diversity and innovation, expanding the scope of what a Crypto Coin can achieve. They play a critical role in the evolution of the cryptocurrency market, offering investors and developers numerous opportunities and challenges alike.

Popular Altcoins and Their Unique Features

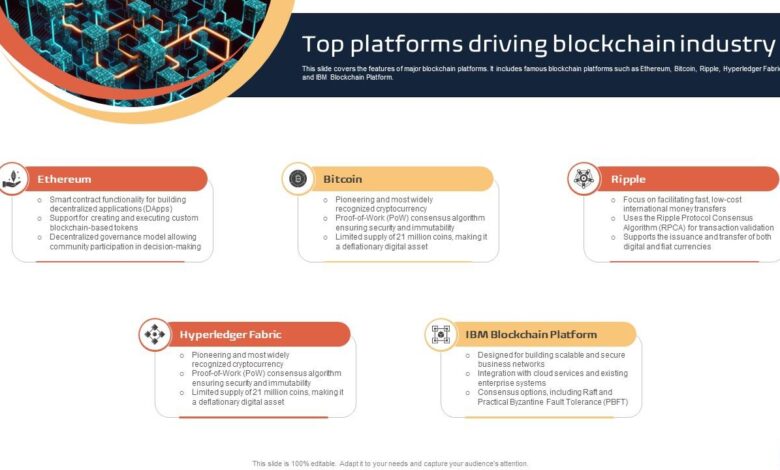

When exploring the world of Crypto Coin, altcoins present a range of opportunities. Below, we highlight some of the most popular altcoins and their unique features:

1. Ethereum (ETH):

- Smart Contracts: Ethereum allows decentralized applications (dApps) to run without downtime, fraud, or interference.

- ERC-20 Tokens: Standards for tokens on the Ethereum blockchain, enabling various projects.

2. Ripple (XRP):

- Fast Transactions: Transactions settle in seconds, versus days for traditional banking.

- Bank Partnerships: Ripple collaborates with financial institutions, enhancing its credibility and adoption.

3. Litecoin (LTC):

- Speed: Transactions are four times faster than Bitcoin.

- Silver to Bitcoin’s Gold: Often considered a lighter, faster alternative to Bitcoin.

4. Cardano (ADA):

- Research-Driven: Academically peer-reviewed, ensuring robust technology.

- Ouroboros Protocol: Aimed at scalable and secure blockchain operations.

5. Polkadot (DOT):

- Interoperability: Connects multiple blockchains, facilitating data and asset transfer.

- Scalability: Allows parallel transaction processing across chains.

When choosing a Crypto Coin, consider these unique features to align with your investment goals. Using this information, you can navigate the altcoin market more effectively.

How to Invest in Altcoins: Tips and Strategies

Investing in altcoins offers a unique opportunity to diversify your crypto coin portfolio. Understanding and implementing effective strategies can help mitigate risks and maximize rewards. Here are some essential tips:

-

Research Extensively:

- Analyze Whitepapers: Whitepapers contain information about a crypto coin’s technology, purpose, and potential. Scrutinize these documents critically.

- Check Developer Teams: Strong, transparent, and experienced developer teams often indicate a project with higher potential.

- Community Engagement: Active communities can provide insights, updates, and support surrounding a particular altcoin.

-

Risk Management:

- Diversification: Spread your investments across multiple altcoins to reduce risk. Avoid putting all your capital into one crypto coin.

- Set Stop-Loss Orders: Determine the maximum loss you are willing to accept on a particular altcoin investment to protect your portfolio.

- Limit Investment Amounts: Do not invest amounts you cannot afford to lose.

-

Stay Informed:

- Follow Market Trends: Regularly update yourself with trends and news in the altcoin market.

- Regulatory Developments: governmental regulations affect the cryptocurrency markets significantly. Keep abreast of these changes to make informed decisions.

-

Use Secure Exchanges:

- Reputation and Security: Opt for exchanges with robust security features and good reputations.

- Transaction Fees: Compare fees across exchanges to ensure you are not paying excessive amounts for buying and selling altcoins.

By incorporating these strategies, you can enhance your potential for successful investment in the diverse world of altcoins.

Risks and Rewards of Investing in Altcoins

Investing in altcoins can offer significant rewards, but it comes with inherent risks that potential investors must consider. Understanding these aspects is crucial before diving into the world of crypto coins.

Risks

1. Volatility:

- Altcoins often exhibit extreme price fluctuations.

- Sudden market changes can lead to substantial financial losses.

2. Regulatory Uncertainty:

- Regulations regarding crypto coins vary globally and can change rapidly.

- New regulations can impact altcoin values negatively.

3. Security Concerns:

- Altcoins are susceptible to hacking and scams.

- Losses from cyber-attacks are often irreversible.

Rewards

1. High Return Potential:

- Successful altcoins can provide exponential investment returns.

- Early adopters of promising altcoins may achieve significant gains.

2. Diversification:

- Adding altcoins to an investment portfolio can lower overall financial risk.

- Altcoins offer various potentials not limited to Bitcoin.

3. Innovation:

- Investment in altcoins supports technological advancements.

- Altcoin projects often introduce groundbreaking blockchain applications.

By carefully weighing the risks and rewards of investing in altcoins, investors can make informed decisions about their crypto coin investments. Understanding these factors will help navigate the volatile and exciting world of altcoins.

Frequently Asked Questions

What are altcoins?

Altcoins, short for "alternative coins," refer to all cryptocurrencies other than Bitcoin. Bitcoin was the first cryptocurrency and remains the most well-known and valuable. Altcoins encompass a wide range of digital assets, each with its unique blockchain technology, use cases, and features. Prominent examples of altcoins include Ethereum, Ripple (XRP), Litecoin, and Cardano.

How do altcoins differ from Bitcoin?

While Bitcoin was designed primarily as a digital currency, many altcoins have been developed to solve various problems or to add functionalities that Bitcoin does not offer. For instance, Ethereum introduced smart contracts and the concept of decentralized applications (DApps), which allow for automated and self-executing contracts, expanding the utility of blockchain technology beyond mere transactions. Other altcoins may focus on faster transaction times, lower fees, enhanced privacy, or specific use cases like supply chain management or digital identity verification.

Is investing in altcoins riskier than investing in Bitcoin?

Investing in altcoins can be riskier than investing in Bitcoin due to several factors. Altcoins generally have smaller market capitalizations and less liquidity, making them more susceptible to large price fluctuations and market manipulation. Moreover, the long-term viability of many altcoins is uncertain, and they may face regulatory challenges, technological issues, or competition from new entrants. Before investing, it is crucial to conduct thorough research and understand the specific risks associated with each altcoin.

How can I purchase altcoins?

Purchasing altcoins generally involves a few steps. First, you need to choose a reputable cryptocurrency exchange that supports the altcoin you wish to buy. Popular exchanges like Binance, Kraken, and Coinbase offer a wide variety of altcoins. You will need to create an account on the exchange and complete any necessary identity verification processes. Afterward, you can deposit funds, usually in the form of fiat currency (like USD or EUR) or cryptocurrency (like Bitcoin or Ethereum), and use those funds to buy your desired altcoin. It is highly recommended to store your purchased altcoins in a secure wallet rather than keeping them on the exchange to minimize the risk of hacking or other security breaches.