Smart Digital Group’s Cryptocurrency Venture: A Market Overview

In a surprising turn of events, Smart Digital Group, a company listed on the Nasdaq, witnessed a drastic decline in its share value. This occurred after the announcement of their ambitious plan to establish a cryptocurrency asset pool, primarily focusing on Bitcoin and Ethereum.

Exploring the Company Announcement and the Lack of Specifics

Smart Digital Group made public their intentions through a press release, highlighting their aspiration to develop an asset pool centered around the stability and transparency of leading digital currencies, Bitcoin and Ethereum. However, the announcement fell short of providing substantial details regarding the pool’s size and allocation strategy. The company indicated that additional information would be shared later, contingent on regulatory approvals and prevailing market conditions. This lack of concrete data left investors with insufficient insights for evaluation.

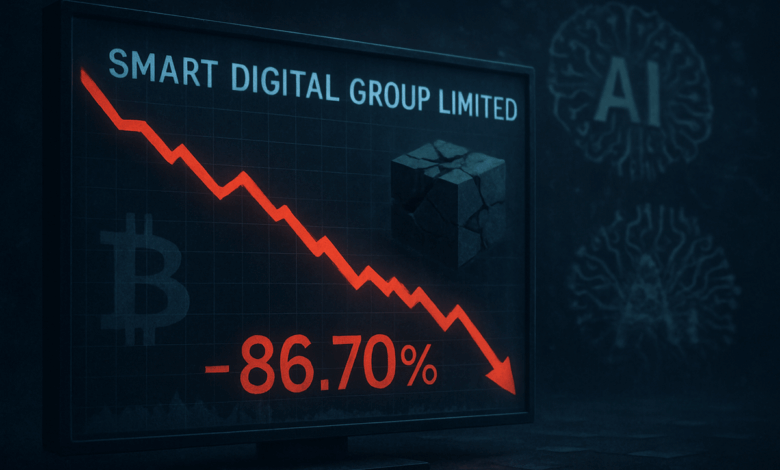

Market Reaction and Share Price Volatility

Following the declaration, Smart Digital Group’s stock experienced a dramatic fall, with prices plummeting to intraday lows between $1.63 and $1.88. This represented a staggering drop of approximately 87%, erasing significant market value in an instant. Earlier in the year, the company had been a market favorite, boasting a market capitalization of around $364 million and recording a remarkable 123% increase over six months. However, this recent downturn wiped out most of those gains.

The cryptocurrency market remains substantial, with a total market capitalization of approximately $3.73 trillion. Analysts attributed the sharp decline in stock prices to two primary factors: panic selling by retail investors and aggressive re-pricing by short sellers. Many investors had anticipated clearer guidelines regarding the use of corporate funds and assets, leading to heightened uncertainty and volatility.

Regulatory Concerns and Analyst Observations

Regulatory bodies, such as the SEC and FINRA, have been closely monitoring trading activities related to corporate ventures into cryptocurrency. In this instance, both agencies expressed interest in the developments surrounding Smart Digital Group. Analysts emphasized the red flag raised by the lack of detailed disclosures, noting that companies that have successfully transitioned into crypto markets have done so by clearly outlining their strategies and sources of funds.

Some market experts warned that the current downturn might be an overreaction, as rapid shifts in confidence often result in price movements that exceed fundamental justifications. Moreover, the decision to divert a portion of the corporate balance sheet into volatile digital assets introduces challenges related to accounting, custody, and regulatory compliance.

A Closer Look at Editorial Integrity

At Bitcoinist, our editorial process is dedicated to delivering thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, with each article undergoing meticulous review by our team of seasoned technology experts and editors. This rigorous process ensures that we provide our readers with content that is both credible and valuable.