Anthony Scaramucci Advocates for a Strategic Bitcoin Reserve in the U.S.

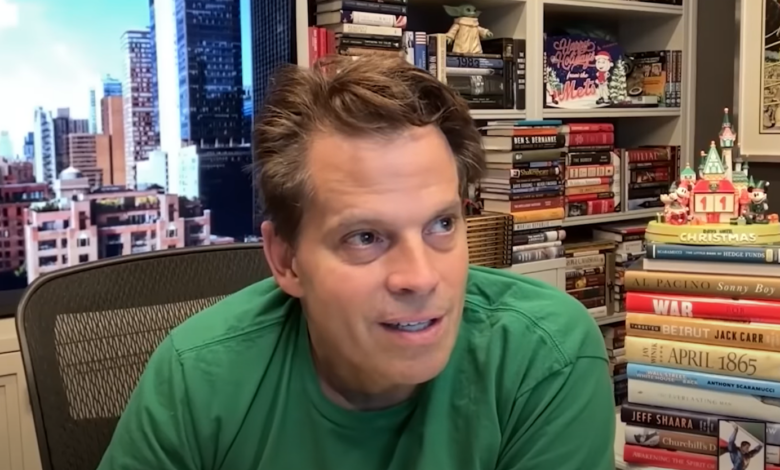

Anthony Scaramucci, the visionary behind SkyBridge Capital and author of the anticipated book, “The Little Book of Bitcoin,” has made a bold assertion regarding the potential adoption of Bitcoin by the U.S. government. In a revealing conversation on the Bankless podcast with Ryan Sean Adams, Scaramucci predicted that a significant acquisition of Bitcoin—possibly up to 500,000 BTC—could gain traction in the U.S. Senate. This move, he suggests, is part of a strategic pivot towards establishing a Bitcoin reserve, despite concerns about its potential impact on the U.S. dollar’s stability.

Could Trump Be the Catalyst for a Government Bitcoin Purchase?

Scaramucci, who maintains influential connections with legislators, shared insights on the Senate’s stance toward a possible government Bitcoin acquisition. He cited considerable support for Senator Cynthia Lummis’ proposal. “They’ve got the votes. Hagerty wants it. McCormack wants it,” Scaramucci noted. When asked if the Senate would approve expanding the government’s Bitcoin reserves, he confidently responded, “I do think so, yes.”

Although the initial proposal from Senator Lummis included acquiring up to one million BTC, Scaramucci speculated that the ultimate plan might vary. He mentioned, “This stuff gets horse-traded, so you’ll probably have 200,000 BTC won’t get sold—they’ll probably buy another 400,000 or 500,000 Bitcoin over the next […],” while refraining from specifying a timeline.

He further emphasized that former President Donald Trump could play a pivotal role in advancing this initiative. “Trump wants it to happen, and he’s got the Senate Banking Committee. Tim Scott wants it to happen—he’s going to be the chair of the Senate Banking Committee,” Scaramucci remarked.

The Potential for Bipartisan Support

One of the most striking aspects of Scaramucci’s comments is the possibility of bipartisan backing for a strategic Bitcoin reserve. Despite opposition from notable figures such as Senator Elizabeth Warren (D-MA) and Senator Sherrod Brown (D-OH), who have criticized pro-Bitcoin and cryptocurrency measures in the past, Scaramucci remains optimistic. He referenced prior legislation, noting that “a lot of Democrats voted for the SAB 121 Bill,” and added, “If you looked at the dispersion of the vote, it was a bipartisan approval of that bill. And by the way, Ryan, if you were below the age of 60 and a Democrat, you voted for the bill. If you were a fossil like Elizabeth Warren or Sherrod Brown, you voted against it.”

He also mentioned Ro Khanna (D-CA) as a Democrat likely to support the idea of a strategic Bitcoin reserve. According to Scaramucci, many younger legislators are beginning to perceive Bitcoin as “digital gold,” making them more amenable to incorporating it into national reserves.

Comparing Bitcoin to Gold: A Strategic Perspective

A central theme in Scaramucci’s advocacy for a strategic Bitcoin reserve is its comparison to gold. The U.S. currently holds approximately $600 billion worth of gold in its reserves. In Scaramucci’s view, allocating even a portion of that amount to Bitcoin, potentially through selling some gold reserves, could strengthen the U.S. economy amid digital transformation.

“If Bitcoin is digital gold, and we have $600 billion of gold on reserve at our Federal Reserve Bank, you’re telling me we couldn’t put $750 million to $1 billion of Bitcoin on reserve? Is that what you’re saying?” he questioned, underscoring the feasibility of such a strategy.

Scaramucci’s vision extends beyond merely holding BTC; he warns that if China or other major economies rapidly adopt Bitcoin reserves, the U.S. might lose a strategic edge. He highlighted that the potential cost for purchasing 400,000 to 500,000 BTC could range between $70–$80 billion—constituting just 1–1.5% of a $6 trillion federal budget, or roughly 30 basis points spread over five years.

“If you put me in that seat and said, ‘Is it in the United States’ national interest to have a strategic reserve in Bitcoin?’ I would say yes,” Scaramucci expressed. “And then if you said to me why, I would say three reasons. Number one, I do believe it’s digital gold. Number two, the younger generation is going to live much further in the digital world than me. Number three, we believe, rightly or wrongly, that the Chinese are going to move to buy Bitcoin.”

The Debate Over Bitcoin and the U.S. Dollar

Critics of a U.S. Strategic Bitcoin Reserve often argue that building a substantial reserve could undermine global confidence in the U.S. dollar, leading to questions about the currency’s backing. However, Scaramucci offers a different perspective, suggesting that the U.S. could bolster the dollar’s standing by remaining technologically competitive.

“Maybe because I’ve been in the space longer, I think we’re further along,” he reflected. “We’re in a modern society. And Trump wants to make a statement. If we believe that the Chinese are going to move to make [Bitcoin] a strategic reserve asset, then what are we talking about? You’re talking about a small percentage of the budget to buy Bitcoin over five years, which could strengthen the dollar emotionally and put the United States on better competitive footing.”

At the time of this writing, Bitcoin was trading at $93,702.

“`