Comprehensive Analysis: Strategy’s Bitcoin Exposure and Market Indices

Our thoroughly vetted editorial content is crafted by industry leaders and experienced editors.

Strategy’s Challenges with Major Indices

Recent reports from NewsBTC have highlighted the challenges faced by Strategy, formerly MicroStrategy, under the leadership of Michael Saylor. The firm is navigating increased scrutiny due to its substantial Bitcoin (BTC) holdings, potentially affecting its inclusion in key indices such as the MSCI USA and Nasdaq 100. This scrutiny is linked to the volatility in the cryptocurrency market, which has seen Bitcoin’s value decline by over 30% from its peak, marking one of its most challenging periods since November 2022.

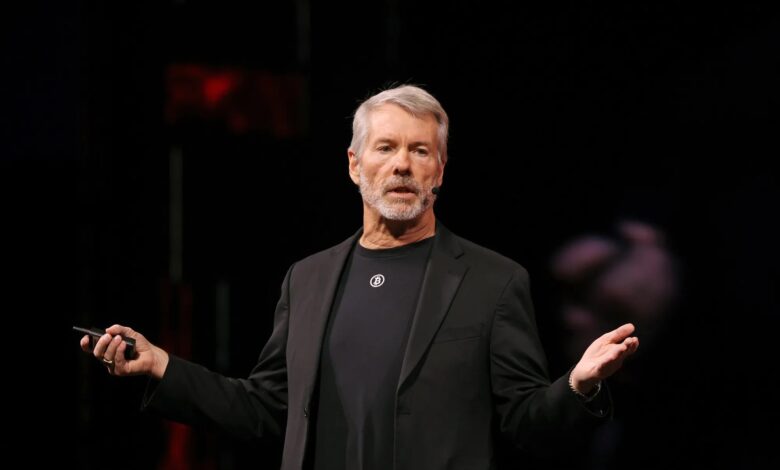

Michael Saylor’s Strategic Vision

As the largest public holder of Bitcoin, with over 650,000 coins, Strategy is confronting the possibility of removal from important benchmark indices. These indices are vital for maintaining the company’s prominence among investors and ensuring its integration into diverse investment portfolios.

In light of these concerns, Saylor used the social media platform X (formerly Twitter) to clarify Strategy’s role. He emphasized that Strategy is not a fund, trust, or holding company. Instead, it operates as a publicly traded entity with a $500 million software business, leveraging Bitcoin as a productive capital through a distinctive treasury strategy.

This year, Strategy has launched five public offerings of digital credit securities—namely STRK, STRF, STRD, STRC, and STRE—accumulating over $7.7 billion in notional value. Additionally, the firm introduced Stretch (STRC), a Bitcoin-backed treasury credit instrument designed to offer variable USD yields to both institutional and retail investors.

Saylor underscored that unlike funds and trusts, which passively hold assets, Strategy actively engages in the creation, structuring, issuing, and operation of financial products. He envisions the company as a pioneering Bitcoin-backed structured finance entity capable of innovation in both capital markets and software development. Saylor also asserted that index classification should not define the firm’s identity, reiterating their unwavering conviction in Bitcoin and commitment to establishing a groundbreaking digital monetary institution based on sound money principles and financial innovation.

Potential Exclusion of Digital Asset Firms by MSCI

Analysts at JPMorgan have expressed concerns regarding MSCI’s potential decision on January 15, 2026. They predict that exclusion from key indices could result in Strategy-related outflows ranging from $2.8 billion to $8.8 billion. Although active managers are not bound to adhere to index changes, exclusion could be perceived negatively, leading to diminished liquidity and increased funding costs.

MSCI has communicated to stakeholders that some market participants view digital asset treasury firms (DATs) as akin to investment funds, potentially disqualifying them from index inclusion. To address this perception, MSCI is considering excluding companies with digital asset holdings comprising 50% or more of their total assets from its global investment market indices.

Recent trends show MSTR’s valuation declining, reflecting Bitcoin’s price fluctuations.

Commitment to Editorial Integrity

Our editorial team at Bitcoinist is dedicated to providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, ensuring each article undergoes rigorous review by top technology experts and experienced editors. This commitment guarantees the integrity, relevance, and value of our content for our readers.