When it comes to altcoin trading, the possibilities are endless. From scalping to yield farming, there are numerous strategies you can use to make profitable returns in the markets. However, with the increasing competition and market volatility, it’s becoming more challenging to succeed. Here are some altcoin trading strategies that you can consider:

Scalping

Scalping is a short-term trading strategy that involves making quick trades to profit from small price movements. This strategy requires quick decision-making and execution, as well as a good understanding of market trends.

Swing Trading

Swing trading involves holding onto a coin for a few days or weeks to capture larger price movements. This strategy requires patience and the ability to analyze market trends to determine the best entry and exit points.

Yield Farming

Yield farming involves providing liquidity to decentralized finance (DeFi) protocols in exchange for rewards. This strategy can be profitable, but it also comes with risks such as impermanent loss.

Airdrop Hunting

Airdrop hunting involves participating in token airdrops to receive free tokens. While this strategy can be lucrative, it requires staying up-to-date on upcoming airdrops and following strict guidelines to qualify.

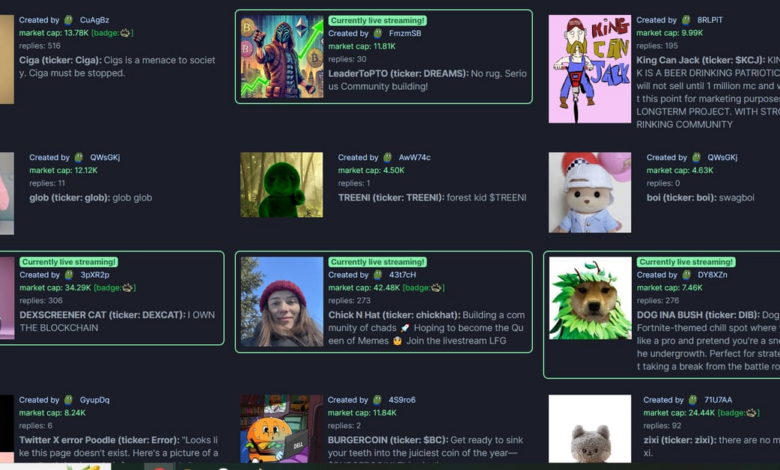

New-Launch Sniper

The new-launch sniper strategy involves investing in newly launched altcoins with the potential for high returns. This strategy can be risky, as new projects often have limited liquidity and may be prone to price manipulation.

Overall, altcoin trading offers a wealth of opportunities for savvy traders. By carefully considering your risk tolerance and investment goals, you can develop a trading strategy that suits your needs and helps you achieve juicy returns in the volatile altcoin markets.