Bitcoin’s Unprecedented Journey and the Legacy of Satoshi Nakamoto

An Unforgettable Milestone in Bitcoin’s Evolution

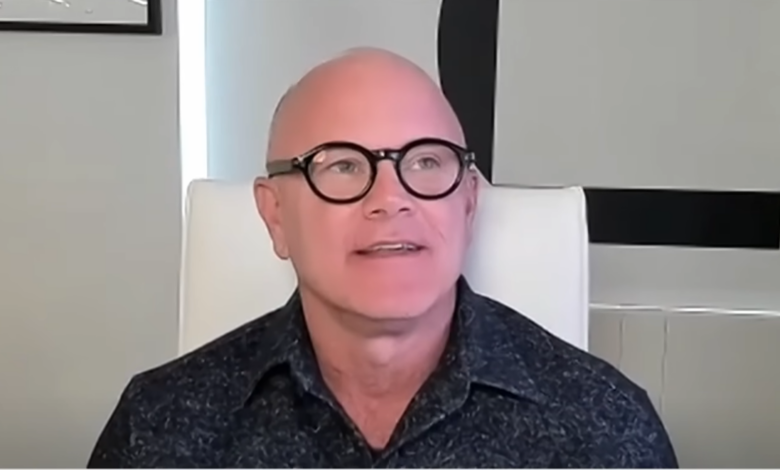

In a captivating discussion on CNBC’s “The Exchange” on December 5, Galaxy CEO and founder Mike Novogratz delved into Bitcoin’s phenomenal rise, reigniting intrigue around its elusive creator, Satoshi Nakamoto. Novogratz’s commentary arrives as Bitcoin achieves a monumental $100,000 valuation, a staggering climb from its inception as a conceptual white paper merely 15 years ago.

The Community-Driven Rise of Bitcoin

Novogratz took a moment to honor the grassroots community pivotal in Bitcoin’s widespread acceptance. “If Satoshi were alive, I’d wager he’d be grinning widely,” Novogratz remarked, highlighting the enduring mystery surrounding Bitcoin’s pseudonymous architect. While Satoshi’s true identity remains a mystery, the implication of his potential demise is a rare topic openly addressed by influential figures in the cryptocurrency realm.

An Idea Transcending Financial Markets

Novogratz eloquently described Bitcoin as a revolutionary technology and social construct that has united diverse individuals in a shared vision. He celebrated the collective achievement, stating, “A $2 trillion asset in just 15 years, born from one individual’s idea, is nothing short of remarkable.” The Galaxy CEO’s words underscore the transformative impact of digital currencies.

The Implications of a Generational Wealth Shift

As an early Bitcoin investor, Novogratz reflected on the immense wealth generated by digital assets, particularly noting the past three months as possibly “the greatest wealth surge for individuals aged 25 to 45 in history” due to Bitcoin’s price doubling. This generational wealth shift, he argued, holds significant economic implications. “Approximately 22-23% of these wealth shocks translate into consumer spending. People will be purchasing homes and vehicles, influencing economic dynamics,” Novogratz explained.

The Reluctance to Liquidate

Despite substantial gains, many crypto enthusiasts remain hesitant to sell, indicative of Bitcoin’s role as a belief system rather than a mere financial asset. “For many, Bitcoin is more a belief system than a financial instrument,” Novogratz asserted, emphasizing the deep-rooted conviction among holders.

Navigating Bitcoin’s Volatility and Regulatory Landscape

While praising Bitcoin’s global coalition-driven growth, Novogratz cautioned investors about inevitable market volatility. He warned of potential “vicious retracements” that could challenge investors, given the high leverage in the market.

Hopeful Outlook on Regulatory Changes

Transitioning to regulatory matters, Novogratz expressed optimism regarding the new US administration’s stance on digital assets. He criticized the previous “four years of detrimental regulation,” but anticipated that the current administration could foster growth and innovation in the cryptocurrency sector. “We now have a president who, regardless of opinion, is favorable for the crypto industry, with a team inclined towards supporting digital currencies,” Novogratz concluded.

As of the latest update, Bitcoin is trading at $97,587, just shy of the $98,000 mark.