The recent report highlighted that MicroStrategy, a prominent publicly-traded company, is heavily invested in bitcoin. The company’s valuation is closely tied to its bitcoin holdings, with experts warning that if MicroStrategy were to sell a portion of its bitcoin stash, it could potentially lose its valuation premium.

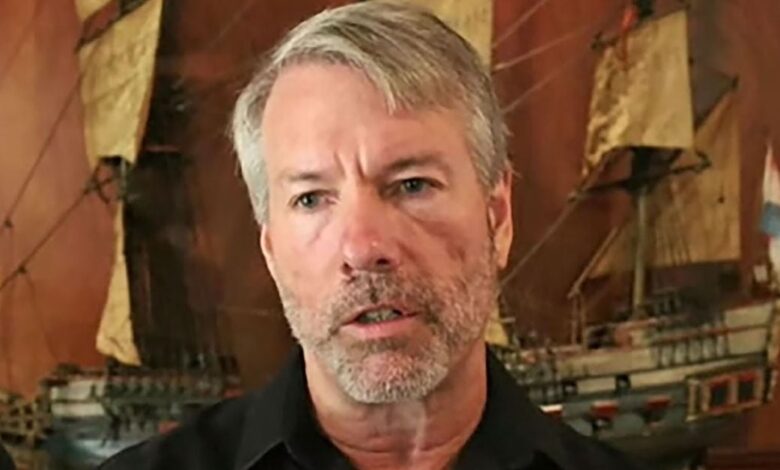

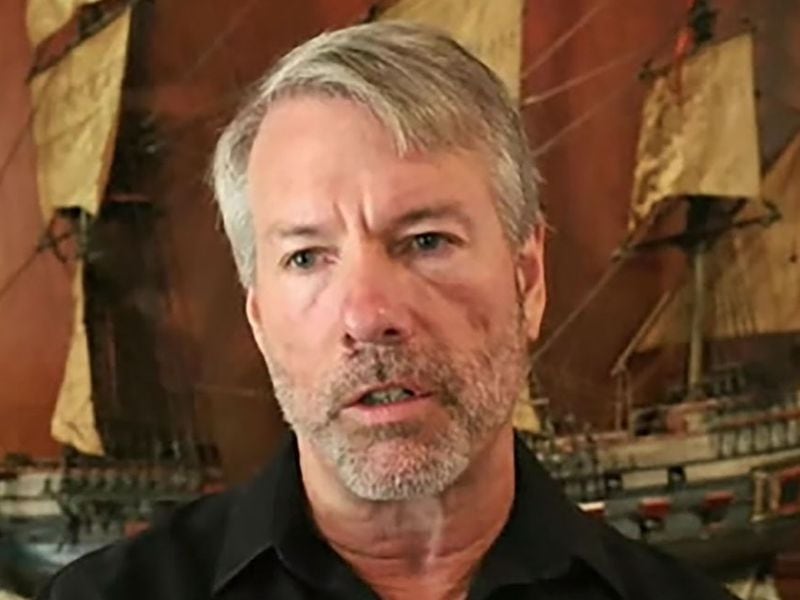

Despite this risk, Michael Saylor, the CEO of MicroStrategy, has made it clear that he has no intention of selling any of the company’s bitcoin reserves. In a statement, Saylor emphasized that he views bitcoin as the ultimate exit strategy for the company, indicating his strong belief in the long-term potential of the cryptocurrency.

MicroStrategy’s unwavering commitment to holding bitcoin has garnered attention in the financial world, with many investors closely monitoring the company’s stance on cryptocurrency. As bitcoin continues to gain mainstream acceptance, MicroStrategy’s bold approach to integrating digital assets into its corporate strategy could pave the way for other companies to follow suit.