While not part of the S&P 500 index, MicroStrategy Inc (NASDAQ: MSTR) has remarkably outperformed every stock within it, establishing itself as a foremost player in the financial markets.

Impressive Stock Performance

As of the latest trading session, MicroStrategy’s stock was valued at $388.88. Over the past 30 days, the stock has seen an impressive rally of 78.25%, resulting in a year-to-date (YTD) return of 469.90%. This extraordinary performance underscores the company’s strategic foresight and market acumen.

MicroStrategy’s Bitcoin Ambitions

MicroStrategy stands as the largest corporate holder of Bitcoin (BTC) globally. The company’s ambitious vision revolves around becoming the first Bitcoin-centric bank, offering unmatched returns and exposure to the world’s leading cryptocurrency.

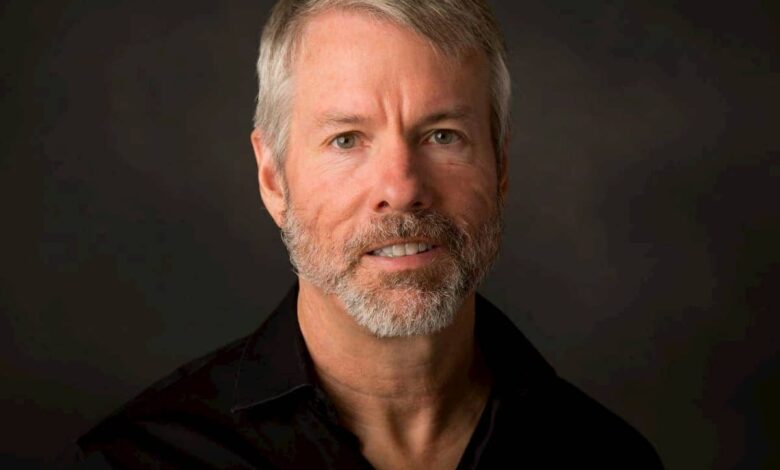

Michael Saylor, the executive chairman of MicroStrategy, has long been a vocal advocate for Bitcoin. Despite skepticism during the cryptocurrency’s bear market, his unwavering commitment to Bitcoin has proven to be a strategic advantage, reinforcing his investment approach.

MicroStrategy’s Strategic Bitcoin Acquisition

Between November 11 and November 18, MicroStrategy made headlines by acquiring a total of 78,980 BTC, as documented in press releases and regulatory filings with the Securities and Exchange Commission (SEC). This substantial acquisition highlights the company’s aggressive strategy in the cryptocurrency space.

How MicroStrategy’s Bitcoin Strategy Works

Unlike traditional cryptocurrency miners who face hefty infrastructure investments and fluctuating energy costs, MicroStrategy employs a unique approach. The company uses a metric known as Bitcoin yield, which evaluates whether its acquisitions benefit shareholders. This metric compares MicroStrategy’s BTC holdings against assumed diluted shares outstanding, including all traded shares and potential shares from convertible notes and stock options.

MicroStrategy finances its BTC purchases through issuing additional shares at the market price and incurring debt. By monitoring the percentage change in Bitcoin yield over time, the company assesses the shareholder value of its acquisitions. In 2024, MicroStrategy achieved a BTC yield of 41.8%, equating to a net gain of 79,130 BTC, or approximately 246 BTC per day, without the high costs associated with mining.

To put this into perspective, achieving this level of Bitcoin accumulation would take all the miners globally around 176 days.

Is MicroStrategy’s Approach to BTC Sustainable?

While Saylor’s strategy has been successful, it is not without risks. In a thriving bull market, the rising BTC prices can offset the impact of share dilution. However, a stagnant or bearish crypto market could pose significant challenges for the company.

The increasing institutional adoption of cryptocurrencies, coupled with political support, reduces the likelihood of adverse market conditions undermining MicroStrategy’s strategy. The company’s broader vision of becoming a pioneering Bitcoin bank holds the potential for sustained success. By leveraging its extensive BTC holdings, MicroStrategy could offer innovative financial services, such as Bitcoin-backed loans, secure custody solutions, and facilitating digital asset transactions.