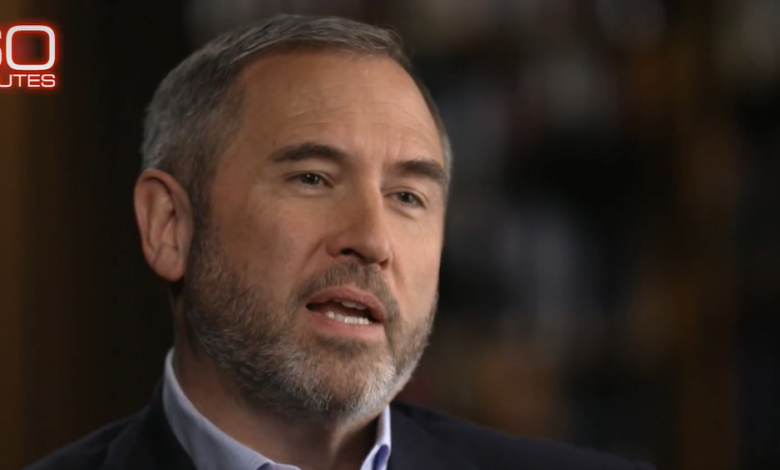

Ripple CEO Brad Garlinghouse Addresses Crypto and Politics on CBS’s “60 Minutes”

In a recent episode of CBS’s renowned program “60 Minutes,” Ripple’s CEO, Brad Garlinghouse, took the spotlight to discuss the intriguing intersection of cryptocurrency and politics. Despite the high-profile nature of the platform, the segment left many within the crypto community feeling underwhelmed, as Garlinghouse’s input was sporadic amidst a broader narrative that lacked in-depth analysis and balance.

Ripple CEO Critiques CBS Coverage

During the approximately 13-minute feature, Garlinghouse was questioned about the significant influence the crypto sector wielded over the US presidential election, particularly through substantial financial contributions from crypto enterprises. CBS underscored that Ripple, alongside other crypto firms, collectively donated $144 million to super PACs backing both Republicans and Democrats.

Garlinghouse acknowledged the effectiveness of these contributions in shaping electoral outcomes, particularly in critical races such as the elections of Democratic senators in Michigan and Arizona. He remarked, “Do I think we had an impact in electing a Democratic senator in Michigan, Alyssa Slotkin? Yes, definitely. And in Arizona? A Democratic senator in Arizona, Gallego? Absolutely.”

On the subject of regulation, Garlinghouse emphasized the industry’s pursuit of explicit legislative guidelines. He stressed the necessity of establishing “clear rules of the road” to ensure the United States maintains its leadership in the crypto space instead of driving the industry offshore where protections are minimal. “We’ve been asking to be regulated. So we have been saying, hey, look, just give us clear rules of the road,” Garlinghouse stated.

Garlinghouse praised bipartisan initiatives, specifically mentioning the Fit 21 bill as a pivotal step towards a balanced regulatory framework that reallocates certain regulatory responsibilities from the SEC to the Commodity Futures Trading Commission (CFTC). Addressing the XRP lawsuit, CBS aired only a few words from the Ripple CEO: “Their allegation was that Ripple, in our sales of XRP, represented the sale of an unregistered security. […] I went to Harvard Business School. I think I’m reasonably intelligent about what constitutes a security. So never once had I considered the possibility that, okay, maybe XRP is a security.”

Garlinghouse also touched on the shifting political landscape, referencing President-elect Donald Trump’s change of heart on cryptocurrency. Regarding Trump’s crypto initiative, he said, “Whether or not it’s a conflict of interest, the voters have knowingly said we want this person to be our president. Yeah, the voters have spoken more so than I have.”

Following the broadcast, Garlinghouse expressed dissatisfaction via X with the segment, criticizing its lack of thorough coverage on key developments. He noted that the interview omitted Judge Analisa Torres’ ruling that XRP is not a security. “60 Minutes shockingly left out that a Federal Judge ruled that XRP is not a security…Gensler’s shill (John Reed Stark) knows better despite his comments that 60 Minutes chose to air,” Garlinghouse wrote.

He added, “Lastly, to say crypto has no utility is exactly what the naysayers said about the Internet in its earliest days – that it’s nothing more than illicit activity. […] Today, even JPMorgan is coming around on blockchain… (conveniently 60 Minutes also failed to mention that Ripple is doing billions of dollars of KYC-ed transactions for our institutional customers – leveraging XRP to move money cross-border more efficiently than traditional payment rails.)”

Crypto Community Responds to CBS Segment

Perianne Boring, Founder and CEO of The Digital Chamber, also voiced her criticism via X, labeling the segment as a “missed opportunity” for a balanced discussion. She argued that the episode misrepresented crypto advocacy as a threat to democracy, ignoring the First Amendment protections of free speech and property rights inherent in permissionless cryptocurrencies.

“CBSNews failed in its role as a protector of First Amendment values by ignoring these fundamental truths. Instead, it framed American businesses’ advocacy for these rights as unethical political lobbying, misrepresenting the real stakes of the crypto debate,” Boring remarked.

She also contended that the segment relied heavily on John Reed Stark, a former SEC official whose credibility in the crypto space is limited, thereby weakening the opposing viewpoint presented. “This sensationalized rhetoric ignored key facts: crypto transactions are logged on a public, immutable public ledger—the blockchain. […] An actual crypto crime expert would have provided a nuanced, fact-based perspective. Instead, 60 Minutes chose to amplify an unqualified voice, undermining its credibility. […] It’s baffling that 60 Minutes failed to challenge such an easily disproven assertion.”

Boring further criticized the portrayal of the SEC’s stance, highlighting the agency’s own regulatory failures, such as the oversight collapse of the FTX exchange. She argued that blaming FTX’s downfall on crypto itself overlooks the lack of a clear regulatory framework in the United States, which she believes created the conditions for FTX’s growth and eventual collapse. “Had the US established a clear, consistent regulatory framework, domestic exchanges could have taken the lead, operating under U.S. oversight to protect investors and prevent fraud,” she noted.

At the time of writing, XRP was trading at $2.37.

“`