In the wake of the recent presidential debate between Democratic nominee Kamala Harris and Republican candidate Donald Trump, Harris’ winning odds have seen a notable increase. The debate, which ended with both candidates neck and neck in the polls, also had a ripple effect on the cryptocurrency market, causing a slight dip in the price of Bitcoin (BTC) by 1.5%.

Presidential Debate Forgets Crypto

The cryptocurrency community had high hopes for the recent Presidential Debate, anticipating that the candidates would address policies affecting the digital asset industry. The stance of political candidates on digital assets has become a critical consideration for many American voters. A report from global exchange Gemini highlighted that 75% of crypto owners believe that digital asset policies will influence their voting decisions in upcoming elections. Furthermore, 73% of those surveyed indicated they would factor in a candidate’s position on the industry when casting their vote, with 37% stating these policies would significantly impact their decision.

Given this backdrop, investors were keen to hear discussions on cryptocurrency policies during the debate. However, the debate concluded without any mention of the crypto sector. Former US President Donald Trump has shown strong support for the cryptocurrency industry, gaining considerable backing from key figures within the space. Trump has vowed to address the regulatory challenges facing the sector and has promised to put an end to the current administration’s stringent approach towards cryptocurrencies. Additionally, he has expressed intentions to remove Securities and Exchange Commission (SEC) Chairman Gary Gensler from his position if elected.

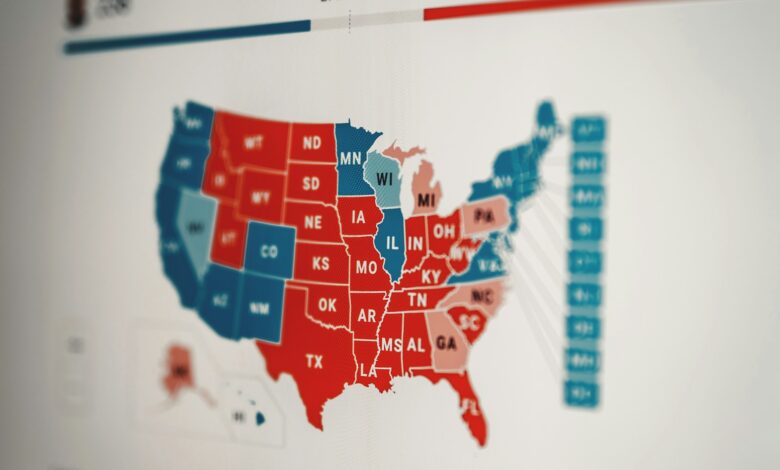

Despite the absence of crypto-related discussions, many within the community felt that Kamala Harris emerged as the debate’s victor. Bitcoin advocate Mike Novogratz commented that Harris “dominated” the debate, jesting that the Republican National Committee (RNC) might consider replacing Trump following his performance. Novogratz also noted that the final outcome of the election would be determined by closely contested states, stating, “Our election will be decided in six states that are gonna be close.”

Some community members expressed disappointment, noting that the debate glossed over pressing issues such as inflation, government overreach, and the Federal Reserve’s monetary policies. QCP Capital conveyed in a Telegram message that Harris seemed to have “won in the court of public opinion,” although it pointed out that neither candidate offered a clear economic policy direction.

VP Harris Takes The Lead

According to Polymarket, the debate resulted in Kamala Harris’ winning odds increasing by 4%. Initially, both Trump and Harris were tied with a 49% chance of winning. However, Harris took a slight lead in the early hours following the debate.

Harris’ odds were further bolstered by an endorsement from global superstar Taylor Swift. In an Instagram post, the American singer distanced herself from Donald Trump, who had recently shared AI-generated images suggesting Swift and her fans supported him. Swift also criticized Trump’s running mate, J.D. Vance, for referring to female Democratic politicians as “childless cat ladies.”

In addition to Swift’s endorsement, Harris received backing from 88 business leaders ahead of the debate, including Ripple’s co-founder Chris Larsen and billionaire Mark Cuban. As of the latest updates, Kamala Harris’ chances of winning the election have reached 50% on Polymarket, surpassing Trump’s 49%. Furthermore, her odds of winning the six pivotal swing states have increased by 2% in prediction markets.

Bitcoin Market Reactions

In the aftermath of the debate, Bitcoin was trading at $56,703 according to the three-day chart on TradingView. The slight decline in Bitcoin’s price reflects the ongoing uncertainty and the market’s sensitivity to political events.

As the election draws nearer, the cryptocurrency community will be closely monitoring the candidates’ positions on digital assets, as these policies have become increasingly significant to American voters and investors alike.