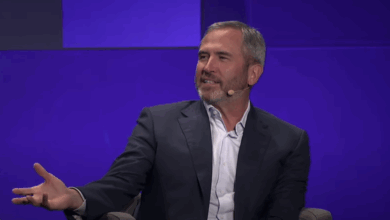

Jack Mallers, the CEO of Strike – a Chicago-based organization that offers BTC payment solutions – is credited with bringing bitcoin (BTC) to El Salvador. On February 21st, he made an absorbing announcement on Twitter about the leading cryptocurrency. Here’s what this was all about…

Jack Mallers: People’s Perspectives on Bitcoin Are Quite Different From Each Other

To some, bitcoin is likened to digital gold. To speculators, it’s an investment opportunity; for techies, it’s a trial and tribulation. And still, others view cryptocurrency as a decentralized alternative to fiat currency. However, Strike CEO Jack Mallers views bitcoin in more grandiose terms: he considers it akin to a central banking system of the Internet – one that provides reliable access across countries and continents at any given moment.

The CEO of Strike confidently vented his firm belief, citing several contributing factors. He articulated that the Bitcoin network is unique in: never altering its monetary policy, being rule-abidingly governed by an array of distributed peers, and issuing currency backed by energy rather than subject to any one state’s authority.

Hyperinflation and “Tyrannical” Central Banks Expand Bitcoin’s Uses

Jack Mallers elucidated that these contrasting factors enable Bitcoin to have distinct characteristics compared to central banks. He reminded us of the fact that traditional banking institutions are under the control of particular entities, and their monetary objectives revolve around employment, inflation, and interest rates in a specific nation. Indeed, Satoshi Nakamoto designed Bitcoin to oppose conventional central banks and their policies; yet we can still consider it as a type of “central bank” due to its potential for generating commerce on the internet platform.

Mallers pinpointed certain occurrences that caused an expansion of the worth and utility of the Bitcoin network, most notably hyperinflation in growing economies and oppressive fiscal surveillance under autocratic governments.

Bitcoin Isn’t “That” Strong Yet

Bitcoin was created 14 years ago with the mission to liberate the Internet from government regulation and the immunity against traditional central bank monetary policies. In particular, its creators sought to protect us all from experiencing a global financial crisis as we did in 2008. Unfortunately, despite these best intentions, Bitcoin has been unable to prevent another potential collapse of our world’s economic system.

You may be interested in: The Majority of Bitcoin Mining Uses Sustainable Energy