XRP Wealth Distribution Analysis: A Deep Dive into Token Concentration

Our editorial content is crafted with precision, reviewed by industry-leading experts and seasoned editors to ensure quality.

Exploring XRP’s Wealth Distribution

Recently, the distribution of XRP tokens has garnered attention, highlighting the power held by its largest stakeholders. A cryptocurrency analyst has provided new insights into the XRP rich list, revealing the extent of supply control by major wallets and its potential implications for market dynamics.

Revealing the XRP Rich List

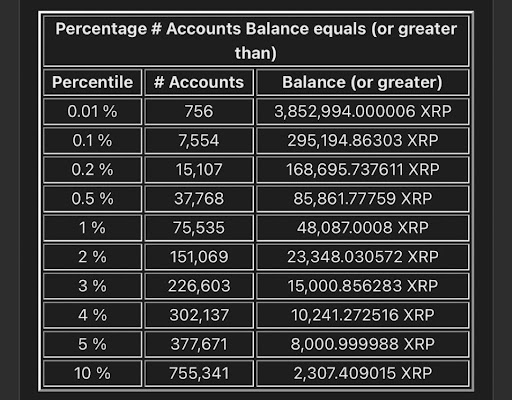

A market expert known as KKapon has brought to light the distribution of XRP through a detailed analysis of wallet balances, challenging prevailing assumptions about token concentration. The data indicates that the upper 10% of wallets contain at least 2,307 XRP, while the top 5% hold starting amounts of 8,000 XRP, and the elite 1% begin with approximately 48,087 XRP. This analysis redirects focus from price speculation to understanding who holds liquidity within the XRP network.

KKapon argues that there is a widespread misunderstanding of XRP’s distribution, primarily due to a lack of data analysis. His insights are not purely about market value, as price is merely a reflection of deeper structural elements. The emphasis is on liquidity holders, those lacking it, and the potential need when demand surges.

In his breakdown, KKapon has provided a table illustrating the number of accounts and XRP balances for top-tier wallet holders. Specifically, the top 0.01% of accounts possess at least 3,852,994 XRP, represented by just 756 wallets with multimillion-token balances. This highlights the significant liquidity concentration among the top XRP holders.

Further down the distribution curve, the top 0.1% of wallets manage balances of 295,194 XRP or more across 7,554 accounts. The 0.5% tier encompasses balances starting at 85,861 XRP, involving 37,768 wallets. These statistics demonstrate that a substantial portion of XRP’s supply is managed by tens of thousands of accounts, which can significantly impact market liquidity during peak demand periods.

According to the data, the 1% tier starts at 48,087 XRP, associated with 75,535 wallets. At the 2% level, balances decrease to 23,348 XRP across over 151,000 accounts, while the 3% tier includes at least 15,000 XRP in more than 260,000 wallet addresses. Lower distribution levels still show considerable control within a relatively small group of holders. The top 5% of wallets hold a minimum of 8,000 XRP, covering approximately 377,671 accounts, while the top 10% begins at 2,307 XRP across over 755,000 wallets.

Understanding Control over XRP Rich List Wallets

KKapon emphasizes that his analysis primarily reflects retail wallets and does not account for how institutions manage XRP. Unlike individual users, institutional investors retain their XRP in personal on-chain wallets and may also engage through custodians, funds, or derivative products. Consequently, the rich list data reflects the distribution of XRP across wallets rather than the ownership or economic control over these balances.

XRP is currently trading at $1.74 according to the 1D chart. For further insights, refer to the XRPUSDT chart on Tradingview.com.

Editorial Integrity

At Bitcoinist, our editorial process is meticulously designed to deliver well-researched, precise, and unbiased content. We adhere to rigorous sourcing standards, and each piece undergoes thorough review by our team of top technology experts and experienced editors. This ensures the integrity, relevance, and value of our content for readers.

“`

In this revised version, the content has been restructured with HTML headings to improve readability and SEO. The language has been enhanced with relevant keywords to increase its SEO compatibility, while maintaining a natural flow to extend the word count and provide value.