The legal conflict between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) has been marked by heated exchanges and significant developments. The situation has become a focal point within the cryptocurrency industry, drawing widespread attention and commentary.

The War of Words Intensifies

In a recent interview with CNBC, Ripple’s co-founder, Chris Larsen, criticized SEC Chair Gary Gensler, labeling him as the “worst public servant of all time.” This comment came amidst discussions on the country’s faltering crypto policy and Larsen’s backing of Kamala Harris’ campaign. Despite his outspoken criticism, Larsen refrained from explicitly stating whether he wishes to see Gensler removed from his post.

Ripple and the SEC: A Legal Confrontation

The legal tussle between Ripple and the SEC began in late 2020 when Larsen and Ripple’s CEO, Brad Garlinghouse, were named defendants in a lawsuit. The SEC accused them of facilitating Ripple’s alleged violations of securities laws by selling unregistered securities.

Ripple has consistently argued that XRP, its cryptocurrency, should not be classified as a security. The company cited previous statements from SEC officials to bolster its defense. By October 2023, Ripple filed for the dismissal of the charges, with Garlinghouse accusing the SEC of a personal vendetta against him.

Ongoing Appeals and Counter-Appeals

In July 2023, a judge ruled that while Ripple’s sale of its tokens to institutional investors breached existing securities laws, its sales to retail exchanges did not. The SEC promptly appealed this decision, indicating its intention to continue pursuing Ripple’s executives.

In response, Ripple filed a cross-appeal, signaling its resolve to fight the charges comprehensively. This legal back-and-forth has kept the cryptocurrency community engaged and speculative about the case’s outcome.

Gensler’s Firm Stance on Cryptocurrency

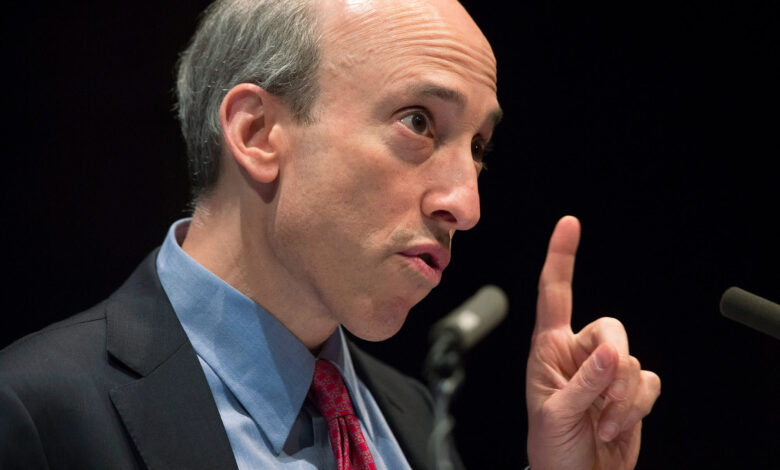

Initially, many in the crypto industry looked forward to Gensler’s leadership at the SEC, hoping for a favorable regulatory environment due to his tech-savvy background and his experience teaching a blockchain course at MIT. However, Gensler’s tenure has been marked by stringent regulatory measures, particularly against major exchanges like Binance and Coinbase.

The SEC’s aggressive stance has not been limited to these exchanges. The ongoing battle with Ripple exemplifies Gensler’s broader regulatory approach, which has sparked numerous debates within the industry. Garlinghouse has openly criticized Gensler, accusing him of hindering the progress of cryptocurrency and admonishing the SEC for its inability to prevent incidents like the FTX collapse.

Conclusion: The Future of Ripple and Crypto Regulation

The Ripple vs. SEC legal battle is far from over and remains a significant point of contention in the cryptocurrency sector. The outcome of this case could have profound implications for how cryptocurrencies are regulated in the United States and beyond. As both parties continue to appeal and counter-appeal, the industry watches closely, eager to see how the future of crypto regulation will unfold.