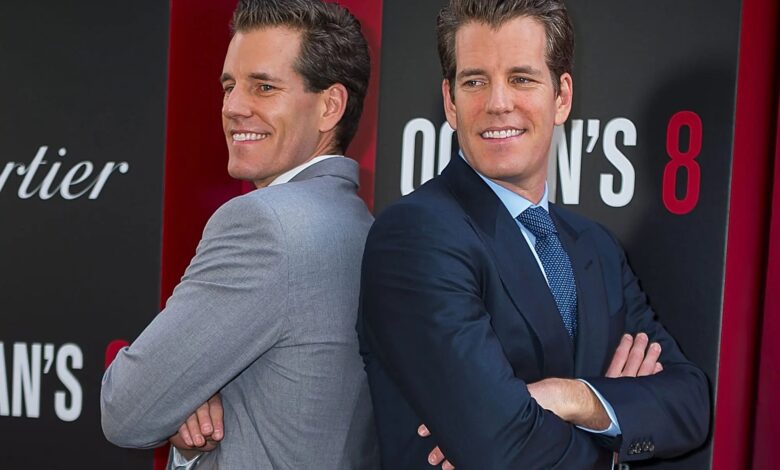

Cameron Winklevoss Announces SEC Closes Gemini Probe

Gemini Investigation Resolution by SEC

In a recent announcement, Cameron Winklevoss, the co-founder of the renowned cryptocurrency exchange Gemini, conveyed that the U.S. Securities and Exchange Commission (SEC) has concluded its investigation into the company. Importantly, the SEC decided not to pursue any enforcement actions against Gemini.

Winklevoss shared details of this development via a social media post, highlighting a letter from the SEC dated February 24. This correspondence revealed that the SEC’s staff did not find grounds to recommend enforcement action against Gemini. The investigation, which spanned 699 days, also involved a Wells Notice issued 277 days prior, indicating potential legal proceedings against the company.

Winklevoss expressed a sense of relief following the SEC’s decision. However, he also reflected on the significant financial burden the investigation imposed on Gemini, estimating legal expenses alone reached “tens of millions of dollars.” Although pleased with the investigation’s closure, he criticized the SEC for employing what he described as “bullying and harassment tactics” against a legitimate industry. He emphasized that such actions by the SEC have broader ramifications, potentially hindering innovation and productivity within the cryptocurrency sector.

Advocating for SEC Reform

The recent decision by the SEC to conclude its investigation into Gemini aligns with a broader trend of easing regulatory pressure on the cryptocurrency market. Notably, the agency has also withdrawn charges against Coinbase Global Inc. and terminated its inquiry into the decentralized finance (DeFi) platform Uniswap. This shift may be indicative of a changing regulatory environment, potentially influenced by political developments, including promises from former President Donald Trump to implement more favorable regulations.

Winklevoss’s statement also included a call for significant reforms within the SEC to prevent similar situations in the future. He proposed that if an investigation is initiated without established guidelines, the agency should compensate the affected parties, tripling their legal costs. Furthermore, he advocated for the immediate dismissal of any individuals involved in what are deemed unjust enforcement actions, suggesting a public disclosure of their names and actions on the SEC’s website.

In concluding his remarks, Winklevoss expressed optimism for the future of the cryptocurrency industry. He recognized this outcome as a vital triumph but emphasized that it represents only the initial step in a broader struggle for fairness and accountability in the regulatory framework.

Market Trends and Future Prospects

As the cryptocurrency market continues to evolve, the total market cap valuation has encountered significant fluctuations, recently trending towards $2.7 trillion. This dynamic environment underscores the importance of adaptive and fair regulatory oversight to ensure the sector’s growth and innovation are not stifled.

Gemini’s experience with the SEC serves as a pivotal example of the challenges and opportunities facing the cryptocurrency industry. It highlights the need for a balanced regulatory approach that fosters innovation while ensuring compliance and protecting investors.

Overall, the closure of the SEC investigation into Gemini marks a significant milestone in the ongoing discourse surrounding cryptocurrency regulation, setting the stage for future developments in this rapidly changing landscape.

“`