Exploring Bitcoin’s Potential Impact on the US Dollar’s Reserve Status

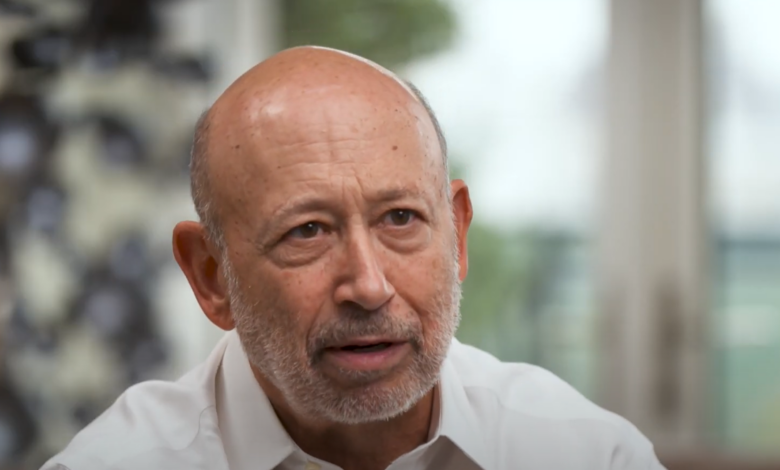

In a noteworthy discussion shared online, Lloyd Blankfein, the former CEO of Goldman Sachs, acknowledged a possible competitive relationship between Bitcoin and the US dollar within the realm of global reserve currencies. Once a skeptic of digital assets, Blankfein now recognizes that Bitcoin’s expanding influence might challenge the long-standing monetary supremacy of the United States.

Blankfein referenced the plans of former US President-elect Donald Trump to establish a strategic Bitcoin reserve, stating, “Trump rightly addressed the significance of maintaining the dollar’s exclusive status as the world’s reserve currency. This supports US trade, aids in financing our deficit, and influences US policy decisions regarding our allies and adversaries. So, why is the new administration so focused on promoting Bitcoin?”

Bitcoin Community Responds to Blankfein’s Views

Pierre Rochard’s Perspective

Pierre Rochard, Vice President of Research at the publicly traded mining firm Riot Platforms (NASDAQ: RIOT), highlighted the competitive nature between the US dollar and Bitcoin. He said, “BREAKING: Lloyd Blankfein, former Goldman Sachs CEO, perceives the US dollar and BITCOIN as competitors for the status of the world’s reserve currency.”

John Haar’s Alternative View

John Haar, leader of Private Client Services at Swan and a former Wall Street portfolio manager, offered a different viewpoint on the matter. Haar remarked, “Perhaps they are not entirely exclusive? It is probable that the USD and Treasuries will maintain their role as the dominant global reserve currency and asset, even as Bitcoin continues to grow in market capitalization and acceptance. Additionally, why do governments hold gold reserves?”

Matthew Pines on Bitcoin’s Strategic Alignment

Matthew Pines, a National Security Fellow at the Bitcoin Policy Institute, suggested that Bitcoin’s growth aligns with US strategic objectives. He noted, “Bitcoin aligns directly with US geoeconomic interests to counter China’s digital authoritarianism, support the Treasury-Dollar system, and uphold our values globally.”

David Marcus’s Insight on Bitcoin and the Dollar

David Marcus, CEO and co-founder of Lightspark and a former leader in Meta’s digital asset initiatives, downplayed the notion that Bitcoin poses a threat to the dollar’s supremacy. He explained, “Bitcoin is not a threat to the dollar’s dominance. It won’t replace the dollar for everyday transactions. Instead, it acts as a digital version of gold with significantly greater utility, serving as a neutral settlement asset between systems and currencies. Bitcoin will ultimately strengthen the USD.”

Eric Weiss’s Agreement

Eric Weiss, CEO of Bitcoin Investment Group, supported Marcus’s sentiment by asserting, “Bitcoin will bolster and spread the USD globally, showcasing a truly synergistic relationship.”

Blankfein’s Evolving Stance on Bitcoin

Blankfein’s current perspective aligns with his previous thoughts on Bitcoin and cryptocurrencies. In 2021, he publicly questioned Bitcoin’s potential as a store of value and suggested that regulators should be vigilant about its emergence. At that time, he stated, “I may be skeptical, but I’m also pragmatic. Therefore, I would certainly want to be involved.”

By January 2022, Blankfein’s viewpoint began to shift. During a CNBC’s “Squawk Box” interview, he highlighted the growing sophistication of the Bitcoin ecosystem, stating, “My perspective is evolving. While I cannot predict the future, I believe it’s crucial to understand the present. When I look at the crypto space, it is indeed happening.” He clarified that by “happening,” he referred to the market’s overall maturation.

At the time of this publication, Bitcoin traded at $97,793.

“`