Ethereum’s Slump Continues: Navigating the Latest Downturn

Our editorial content is trusted and rigorously reviewed by leading industry experts and experienced editors to ensure accuracy and reliability.

Ethereum’s Price Hits New Lows Amid Market Turbulence

The cryptocurrency industry has taken another hit as Ethereum’s price plummets to approximately $1,380, a level not seen since March 2023. This decline has sparked concern among investors, raising questions about the sustainability of Ethereum’s long-term bullish trend. The market remains under pressure due to ongoing macroeconomic challenges, escalating global tensions, and uncertainties stemming from U.S. trade and fiscal policies.

Investor sentiment within the crypto sector is increasingly negative, and Ethereum’s price movements mirror this growing unease. After months of attempting to maintain crucial support levels, Ethereum’s dip below the $1,500 mark has amplified fears of a more severe correction.

Potential Signs of Recovery: Analyzing On-Chain Data

Despite the bleak outlook, there is a potential silver lining. According to data from CryptoRank, Ethereum is currently trading below its realized price, a historically rare event often associated with market bottoms and subsequent recovery phases. Although the short-term forecast remains uncertain, such rare on-chain signals suggest that Ethereum might be entering a key accumulation phase. The coming days and weeks will be pivotal in determining whether this marks a further decline or the beginning of a long-term reversal.

Ethereum Dips Below Realized Price Amid Market Anxiety

Since late March, Ethereum has lost over 33% of its value, triggering widespread concern among investors and market analysts. The dramatic price drop has brought Ethereum to levels not seen in over two years, causing alarm among holders who anticipated a breakout year for altcoins by 2025. Instead, Ethereum has become emblematic of market fragility as broader macroeconomic challenges intensify.

Fears of trade wars, inflationary pressures, and a potential global recession are unsettling financial markets. In this climate, high-risk assets like Ethereum are among the first to be impacted. As capital shifts away from speculative investments towards safer havens, Ethereum’s selloff has intensified, severely denting investor confidence.

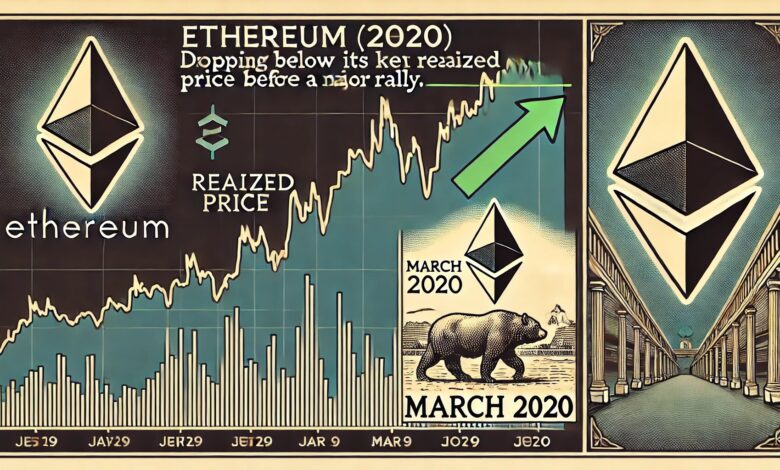

Hope in On-Chain Metrics

However, some data offers a glimmer of hope. Renowned crypto analyst Carl Runefelt recently highlighted on X that Ethereum is trading below its realized price of $2,000, a rare occurrence that has historically marked significant turning points in Ethereum’s price trajectory. Runefelt noted that the last instance of Ethereum dipping below its realized price was in March 2020, when it plummeted from $283 to $109, only to recover robustly in the ensuing months. While the current environment is fraught with uncertainty, such on-chain indicators suggest the possibility of Ethereum entering another accumulation phase.

Nevertheless, confidence remains shaky, and price stabilization is necessary before any genuine bullish narrative can re-emerge. The next movements of Ethereum will be crucial in determining whether this level signifies a true bottom or merely another stop on the downward path.

Ethereum’s Struggle Continues Below $1,500

Ethereum is currently languishing below the $1,500 mark after experiencing a severe 50% decline since late February. This aggressive selloff has wiped out months of gains, leaving investors in a state of uncertainty as Ethereum shows no signs of recovery. Market sentiment remains overwhelmingly bearish, with no clear indication that a bottom has been reached.

Challenges in Defining Support Levels

At this juncture, Ethereum lacks a clearly defined support zone. Bulls have lost their grip, and price action continues to drift lower amid weak demand and mounting fear. For a meaningful reversal to commence, Ethereum must first reclaim the $1,850 level, which previously served as a crucial support and now stands as major resistance. Until this happens, any upward attempt is likely to encounter strong selling pressure.

The situation becomes even more precarious if Ethereum falls below the $1,380 level, which has thus far acted as a psychological threshold. Dropping below this area could pave the way for a deeper correction towards the $1,100–$1,200 range. With macroeconomic tensions remaining high and volatility expected to persist, traders and investors will be closely monitoring whether Ethereum can stabilize or continue its steep decline.

Editorial Integrity and Commitment to Quality

Our editorial process at Bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, and each page undergoes meticulous review by our team of top technology experts and seasoned editors. This rigorous process ensures the integrity, relevance, and value of our content for our readers.