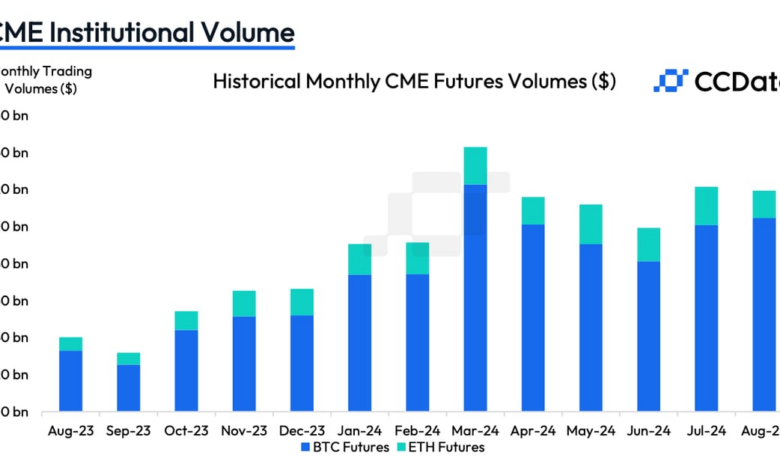

Wintermute’s data reveals that bitcoin futures now make up 48% of the total notional open interest in the cryptocurrency futures market. Other alternative cryptocurrencies, such as ether, account for the remaining percentage. This marks a significant increase from March, when bitcoin only represented 31% of the global open interest.

As the popularity of bitcoin futures continues to rise, it underscores the growing importance of these derivative contracts in the overall crypto market. Investors and traders are increasingly turning to futures contracts to speculate on the price movements of various cryptocurrencies, including bitcoin and ether.

With bitcoin futures commanding a larger share of the market, it suggests that traders are becoming more focused on the leading cryptocurrency and its price movements. This shift in interest could have implications for the broader crypto market as well, as bitcoin often sets the tone for other digital assets.