XRP Investors in Legal Battle: Unmasking Alleged Securities Fraud

The world of fintech has been rocked by a securities-fraud class action involving XRP investors and the former CEO of Linqto, William Sarris. Allegations have surfaced accusing Sarris of secretly imposing excessive mark-ups of up to 60% on pre-IPO shares of Ripple and other coveted private companies like Uphold and Kraken. These transactions were conducted through special-purpose vehicles (SPVs) on Linqto’s platform.

XRP Community Rallies Behind Legal Efforts

The legal complaint, known as Maxwell v. Sarris, was filed on July 9, 2025, in the US District Court for the Southern District of New York. The plaintiffs assert that Sarris, along with unnamed collaborators, acted as unregistered broker-dealers, used misleading offering exemptions, and failed to provide legal titles to the underlying shares.

Unveiling the Allegations

According to the lawsuit, purchasers were led to believe that the SPVs housed the same equity owned by insiders. However, Linqto allegedly neither transferred the shares nor disclosed the significant mark-ups included in the purchase prices. This conduct is claimed to violate Section 10(b) of the Securities Exchange Act and FINRA Rule 2040. Linqto’s own bankruptcy filings in the Southern District of Texas acknowledged past failures in adhering to US laws governing private-company interest sales.

Legal Advocacy for the XRP Community

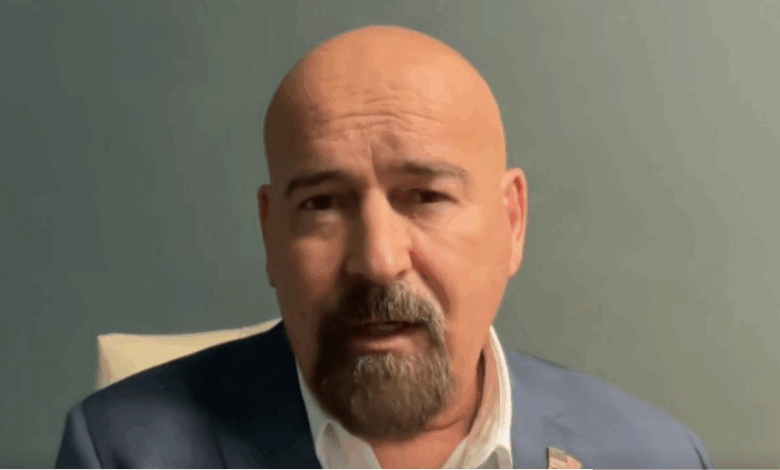

John E. Deaton, the lead counsel and renowned for representing XRP holders in SEC v. Ripple, argues that Sarris undermined the mission of democratizing access to Silicon Valley investments and misled average investors. “People believed they were buying shares of Ripple or SpaceX, but that wasn’t the reality,” Deaton asserted.

Despite Linqto’s Chapter 11 bankruptcy filing on July 8, 2025, Deaton maintains that the lawsuit against Sarris, pursued in a personal capacity, is not impacted. Linqto, under the leadership of CEO Dan Siciliano, has secured up to $60 million in debtor-in-possession financing and emphasizes that court oversight is crucial to becoming a compliant and profitable entity while cooperating with ongoing SEC and FINRA investigations.

Challenges in Investor Communication

Efforts to communicate with investors have faced hurdles. Deaton organized an X Spaces session scheduled for 7:30 p.m. EST on July 9 but had to abandon it due to repeated technical issues. He later assured all Linqto customers, regardless of location, that future communications would include them, promising to set up a phone conference call instead.

Restructuring and Regulatory Pressures

As restructuring discussions intensify, the Sapien Group, a major shareholder, claims to have rallied a majority bloc of equity and may seek to dismiss the Chapter 11 case. Deaton, meanwhile, has signaled his intention to engage with the creditors’ committee, a move supported by forensic accountant Rob Loh. Loh emphasized the committee’s significant influence in the bankruptcy process, a sentiment echoed by Deaton.

Regulatory scrutiny is increasing on multiple fronts, with Linqto disclosing concurrent investigations by the SEC and FINRA. Additionally, former Chief Revenue Officer Gene Zawrotny is pursuing a wrongful-termination claim, alleging retaliation for raising compliance concerns. Deaton is amplifying pressure on behalf of the XRP community, particularly those who believed they were acquiring legitimate pre-IPO shares of Ripple.

Market Context

At the time of reporting, XRP is trading at $2.42, reflecting ongoing market dynamics and investor sentiment.