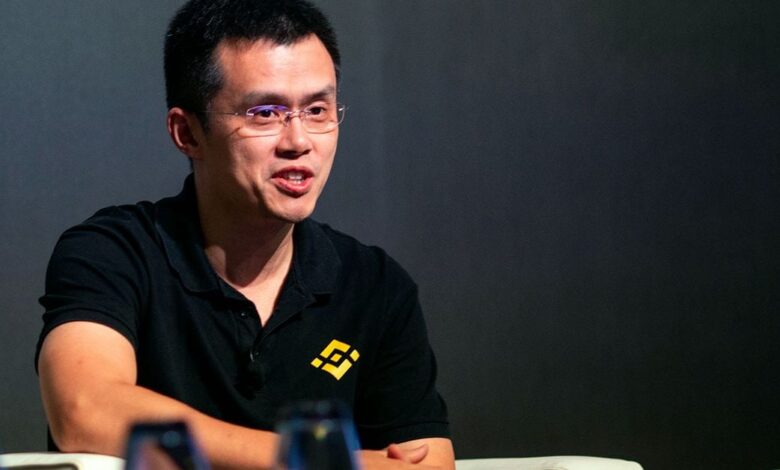

Changpeng Zhao, the former CEO of Binance, was sentenced to four months in prison in April after pleading guilty to violating the Bank Secrecy Act. This violation stemmed from his failure to establish a sufficient know-your-customer (KYC) program at the popular crypto exchange.

As part of his guilty plea, Zhao agreed to pay a hefty $50 million fine and step down from his position as CEO of Binance. This high-profile case has drawn significant attention within the crypto community and serves as a reminder of the importance of regulatory compliance in the industry.

Despite these legal challenges, Binance continues to operate as one of the largest and most influential cryptocurrency exchanges in the world. The company has implemented enhanced KYC measures in response to the incident, aiming to improve transparency and security for its users.

While Zhao’s sentencing marks a significant chapter in the ongoing saga of crypto regulation, it also highlights the need for industry leaders to prioritize compliance and accountability in order to ensure the long-term success and legitimacy of digital assets.