Exploring Budget-Neutral Strategies for Bitcoin Strategic Reserve

Our editorial content is trusted and verified by industry-leading experts and veteran editors. This article includes an ad disclosure.

Introduction to Bitcoin Strategic Reserve Planning

As discussions around the Bitcoin Strategic Reserve (BSR) gain momentum, innovative strategies that maintain a neutral budget are capturing the interest of policymakers. Former US President Donald Trump highlighted the feasibility of the US government building Bitcoin reserves through budget-neutral methods. One interesting proposal involves leveraging gold as a strategic asset.

The Role of Gold in Bitcoin Holdings

Greg Cipolaro from the New York Digital Investment Group (NYDIG) has suggested that the government could tokenize assets like gold to promote transparency. The concept of tokenizing gold isn’t novel; influential figures in the cryptocurrency space, including Elon Musk, have previously advocated for employing blockchain technology in such strategies.

Advancements in Gold Tracking Through Blockchain

There is a burgeoning movement within the Trump administration that advocates for the use of blockchain technology to monitor the nation’s gold reserves. Cipolaro, the global head of research at NYDIG, has proposed that blockchain could be instrumental in tracking gold reserves and their associated expenditures. In a statement on March 21st, Cipolaro pointed out that while blockchains currently offer limited information, they hold significant potential for enhancing transparency.

Benefits of Tokenized Gold for Bitcoin

NYDIG, a Bitcoin subsidiary of asset manager Stone Ridge, suggests that tokenized U.S. gold could ultimately favor the Bitcoin ecosystem. Cipolaro used Bitcoin’s blockchain as an example, highlighting its existing limitations, such as the inability to track asset prices in real time. He emphasized that tokenizing gold reserves on a blockchain could help the government monitor their status and spending, provided there is trust and coordination—a challenge with Bitcoin.

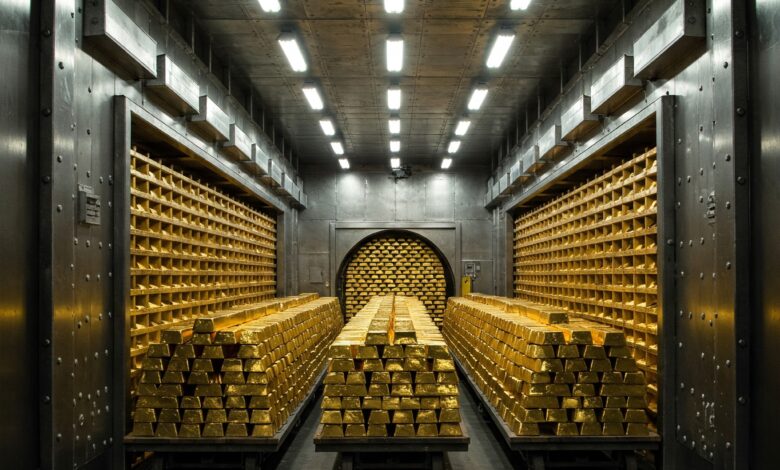

Demands for Enhanced Gold Reserve Auditing

Cipolaro’s advocacy for tokenization aligns with increasing calls for better transparency in the management of the nation’s gold reserves. Recently, Republican figure Rand Paul called on Elon Musk to scrutinize the government’s gold bullion holdings, especially those stored at Fort Knox, which houses nearly half of the country’s reserves. Despite the U.S. Treasury’s role in auditing and reporting on these holdings, both Trump and Musk have raised concerns about the transparency of the current auditing processes.

The Future of Gold Tokenization

In a detailed report released by NYDIG, Cipolaro envisioned a scenario where gold is tokenized. He illustrated a potential case where the Federal Reserve’s 13 million fine troy ounces of gold could be represented by an equivalent number of tokens, dubbed “USTG.” Each USTG token would symbolize one fine troy ounce of gold in the national reserve.

Mechanics of Token Circulation

Cipolaro explained that when the Treasury acquires gold, it could introduce additional USTG tokens into circulation, secured in a digital wallet. Conversely, if reserves are sold, the corresponding tokens could be “burned,” or removed from circulation. When sales occur, the physical gold could be transferred to the buyer, reflecting the token movement.

Conclusion

As the conversation around the Bitcoin Strategic Reserve evolves, the potential tokenization of gold presents an intriguing avenue for enhancing transparency and efficiency. While challenges remain, the integration of blockchain technology into national asset management could redefine traditional practices.

Our Editorial Process

At bitcoinist, we are committed to delivering content that is thoroughly researched, precise, and impartial. We adhere to rigorous sourcing standards, and each article is meticulously reviewed by a team of top technology experts and veteran editors. This diligent process ensures that our content remains informative, relevant, and valuable to our audience.