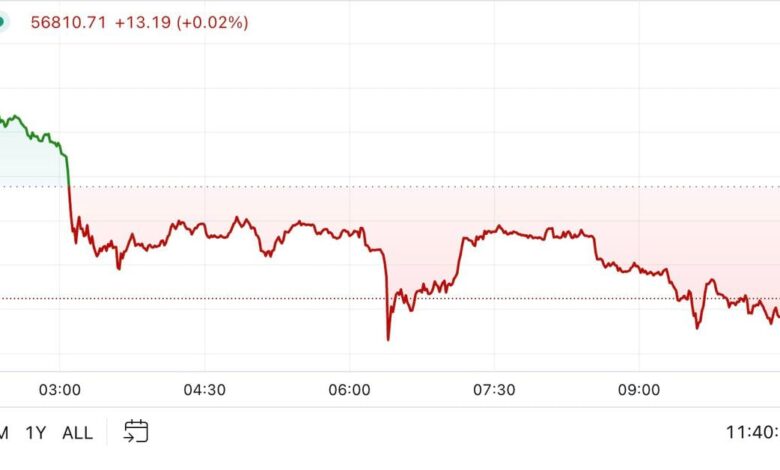

Bitcoin has fallen below $57,000, reversing gains from a brief rally above $58,000 on Wednesday. At the time of writing, BTC is trading around $56,800, which is approximately 0.3% higher than it was 24 hours ago. The broader digital asset market, as measured by the CoinDesk 20 Index, has added about 1%, with SOL and DOGE leading the gains. Bitcoin reached a peak above $65,000 on August 25 and has been on a downward trend since then, with brief, shallow bounces indicating a persistent “sell-on-rise” mentality among investors. This trend is likely due to increasing U.S. recession risks, prompting a reduction in exposure to risk assets.

As the cryptocurrency market continues to fluctuate, it is important for investors to stay informed about the latest trends and developments. Keeping a close eye on Bitcoin’s price movements and market sentiment can help traders make more informed decisions about their investments.

Despite the recent price drop, some analysts remain optimistic about Bitcoin’s long-term prospects, citing its potential as a store of value and hedge against inflation. However, it is always important to do thorough research and consider the risks before investing in any asset, especially in the volatile cryptocurrency market.

Overall, the cryptocurrency market remains highly unpredictable, with prices fluctuating rapidly based on a variety of factors. It is crucial for investors to stay vigilant and stay informed in order to navigate these turbulent waters successfully.