In recent years, the crypto options market has experienced exponential growth, with contracts worth billions of dollars expiring on a monthly and quarterly basis. Despite this rapid expansion, the market remains relatively small compared to the spot market.

According to data from Glassnode, the spot volume as of the latest available figures was approximately $8.2 billion, whereas the options volume stood at around $1.8 billion. This highlights the significant difference in size between the two segments of the market.

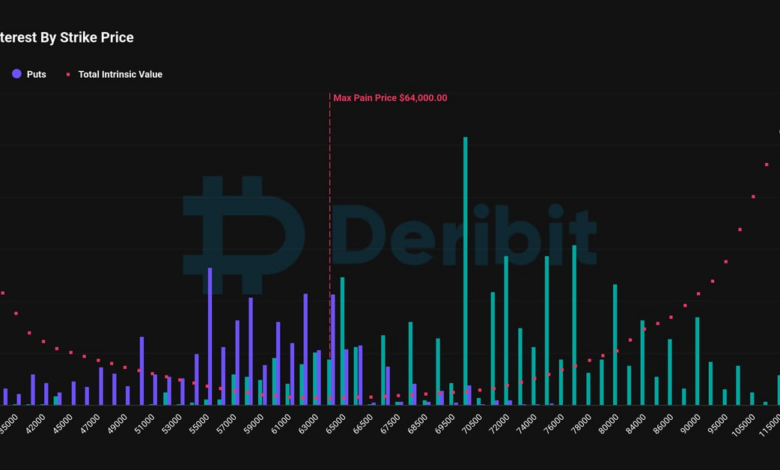

For example, Bitcoin’s open interest, which currently stands at $4.2 billion and is set to expire this Friday, represents less than 1% of Bitcoin’s total market capitalization of $1.36 trillion. This disparity underscores the relatively modest size of the options market compared to the overall cryptocurrency market.