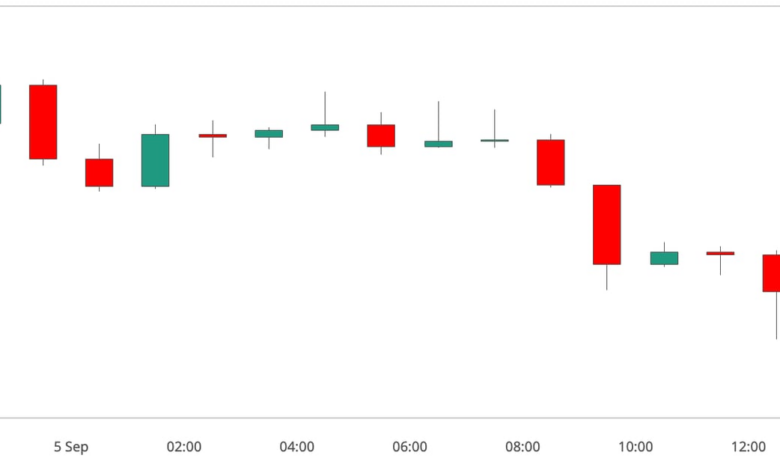

Recently, there has been a growing concern among investors about the potential impact of crypto weakness on traditional risk assets. According to one analyst, the recent downturn in the crypto market could be a red flag for other high-risk investments.

As cryptocurrencies continue to experience volatility and uncertainty, some experts believe that this could spill over into other asset classes. This has led to increased scrutiny and caution among investors who are closely monitoring the situation.

While the correlation between crypto and traditional markets is not always clear, there are indications that a significant drop in crypto prices could signal broader market instability. This has prompted many to reassess their risk exposure and consider diversifying their portfolios.

It is important for investors to stay informed and stay ahead of market trends to navigate these uncertain times. By keeping a close eye on both the crypto market and traditional risk assets, investors can make more informed decisions and protect their investments.