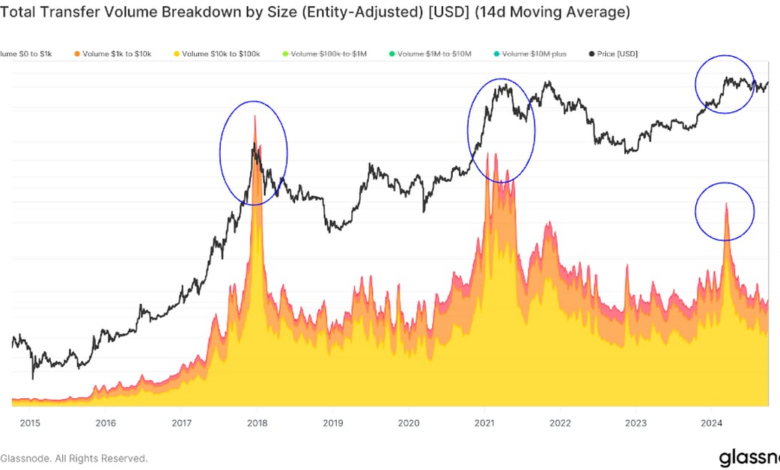

Speculative trading on-chain, whether it’s through inscriptions on bitcoin or transactions involving non-fungible tokens (NFTs) on ether (ETH), serves as a key indicator of retail participation in the market. During bull markets, we often witness high fee levels as investors engage in on-chain speculation, with the 2021 market peak serving as a notable example.

Currently, the usage of NFT gas on ether stands at only 2%, a stark contrast to 2021 when the percentage of gas consumed reached as high as 40%, as per data from Glassnode.