Analyzing the Surge in Gold Prices and Its Implications for Bitcoin

The Unprecedented Rise of Gold

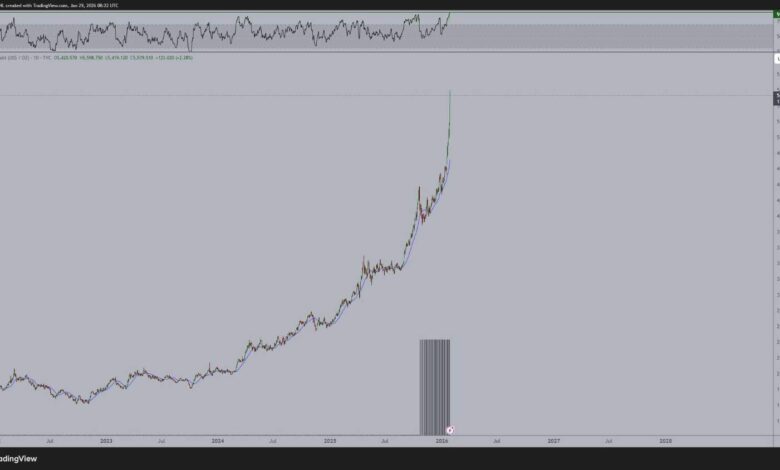

The current momentum in the gold market has reached unparalleled heights, sparking curiosity about the future trajectory not just for gold, but also for the cryptocurrency sector, with a particular focus on Bitcoin (BTC). As gold prices continue to climb, they have driven the Relative Strength Index (RSI) above 91, a scenario witnessed only once before in December 1979, which was followed by an extended consolidation period.

A similar situation unfolded in August 2020 when gold hit record highs. This was immediately followed by a consolidation phase, which coincided with Bitcoin experiencing a dramatic sixfold increase during the next cycle. Investors are now speculating whether gold is on the cusp of another consolidation phase, potentially paving the way for Bitcoin to experience a significant uptick.

Insights from Market Analysts

Michaël van de Poppe, a respected expert in macro markets and cryptocurrency trading, has analyzed the current situation and noted its historical extremity, suggesting it could have a significant impact on Bitcoin. Van de Poppe commented, “Gold’s RSI above 91 has only happened once before — in 1979. It’s now higher than August 2020, which was followed by gold consolidating and Bitcoin rallying 5–6x.”

Gold’s Phenomenal Performance

The recent gold rally can be attributed to escalating geopolitical tensions and a weakening U.S. dollar. Markets have reacted to renewed military threats by the United States, particularly from former President Donald Trump against Iran. As a result, gold prices soared above $5,500 per ounce, marking a more than 20% increase since the beginning of the year. In comparison, last year saw a 64% surge in gold prices, driven by changes in global trade policies and international relations.

The strength of gold prices is further bolstered by diminishing confidence in traditional safe havens like government bonds. Investors are increasingly wary of the mounting public debt in major developed economies, including the United States.

The Role of Monetary Policy

The Federal Reserve’s recent decision to maintain interest rates between 3.5% and 3.75% has also played a role in the gold market’s dynamics. Fed Chair Jerome Powell indicated that the central bank might consider reducing rates if inflationary pressures show signs of abating.

Bitcoin’s Uncertain Path Forward

The future of Bitcoin remains uncertain as the cryptocurrency market grapples with weakening technical indicators against the potential resurgence of institutional interest. Regulatory developments are crucial, as upcoming discussions on U.S. crypto legislation and the potential establishment of a U.S. Strategic Bitcoin Reserve could either stimulate institutional investments or introduce new uncertainties.

Despite these uncertainties, there are positive signals such as the accumulation of Bitcoin by large holders, often referred to as “whales.” This trend typically reduces the liquid supply and has historically been a precursor to volatile market swings.

In conclusion, the market is currently in a state of anticipation, with investors closely monitoring policy changes that could influence the next significant move in a landscape characterized by extreme gold momentum and evolving macroeconomic conditions.

“`

This revised article is designed to meet SEO requirements by incorporating relevant headings, keywords, and a more detailed narrative, offering value to the reader without unnecessary extensions.