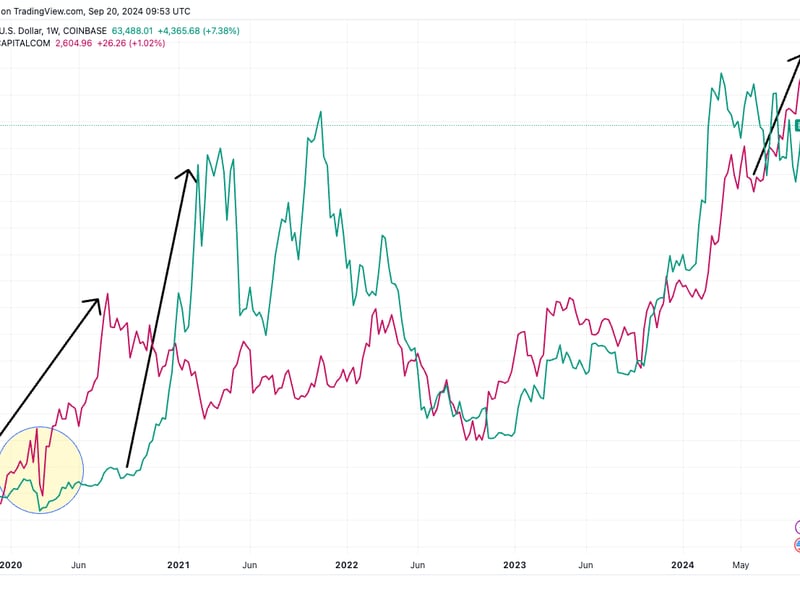

In the past five days, bitcoin (BTC) has surged 7%, breaking through $64,000 for the first time since Aug. 26. Gold, for its part, has reached all-time highs on over 30 occasions this year, topping $2,600 an ounce. These remarkable performances mark the first time since bitcoin’s inception in 2009 that both are the top-performing assets of the year, according to Charlie Bilello, the chief market strategist at Creative Planning, an investment management and financial planning firm.

This recent surge in bitcoin and gold prices has caught the attention of investors worldwide. The volatility and uncertainty in traditional markets have led many to seek alternative investment options, with bitcoin and gold emerging as strong contenders for capital appreciation and wealth preservation.

As the year progresses, experts are closely monitoring the performance of both assets to see if they can maintain their upward momentum. With global economic conditions continuing to evolve rapidly, the role of bitcoin and gold as safe-haven assets may become even more pronounced in the months ahead.