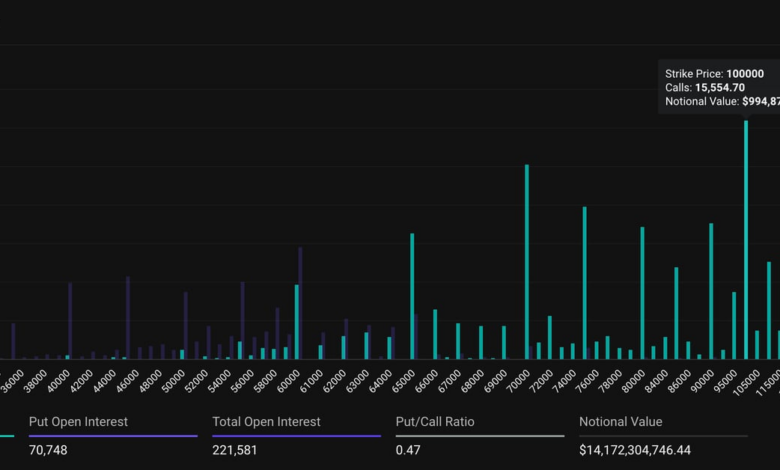

As of the latest data from Deribit Metrics, the dollar value of active call options contracts at the $100,000 strike price has surpassed $993 million. This figure represents the highest value among all other BTC options listed on the exchange. It is important to note that on Deribit, each options contract corresponds to one BTC.

This substantial amount of money tied up in call options at such a high strike price indicates a significant level of bullish sentiment in the market. Investors and traders are wagering that the price of Bitcoin will reach or exceed $100,000 within the specified time frame of the options contract.

With nearly $1 billion in value at stake, the $100,000 strike price is clearly a key level of interest for market participants. The outcome of these options contracts could have a considerable impact on the overall direction of Bitcoin’s price movement in the near future.

It will be fascinating to see how this situation unfolds and whether the market’s expectations for Bitcoin’s price trajectory will be realized. As always, it is essential for investors to carefully monitor and analyze market data to make informed decisions regarding their trading strategies.