Analyzing Recent Trends in the Crypto Futures Market: A Focus on Bitcoin and Solana

Our editorial content is crafted with precision and is reviewed by leading industry experts and seasoned editors to ensure accuracy and reliability.

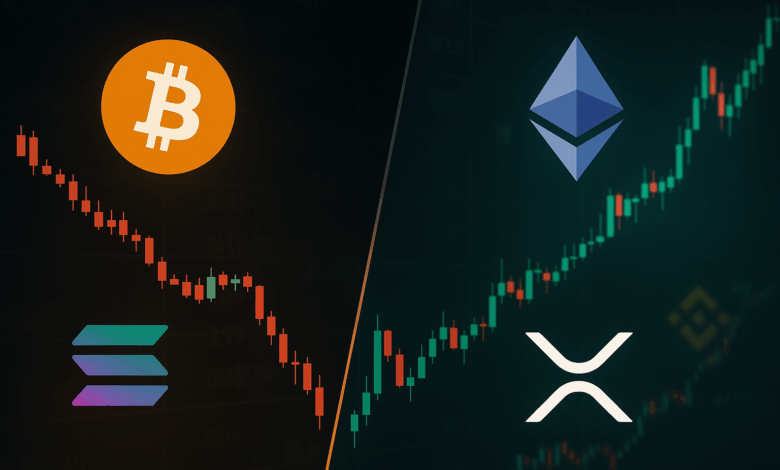

Understanding the Decline in Bitcoin and Solana Perpetual Futures Open Interest

According to a recent analysis by the on-chain analytics firm Glassnode, a notable shift has occurred in the Open Interest of Bitcoin and other leading cryptocurrencies. This Open Interest metric is crucial as it reflects the total number of active perpetual futures positions for a specific asset across all centralized derivatives exchanges.

What is Open Interest?

Open Interest serves as an indicator of market activity in the futures sector. An increase in this metric suggests that investors are initiating new positions, potentially leading to higher leverage and increased market volatility. Conversely, a decrease indicates that positions are either being closed voluntarily or are subject to liquidation, resulting in reduced leverage and potentially more stable price movements.

Recent Trends in Bitcoin Open Interest

In the past week, Bitcoin’s Open Interest has experienced a downward trend, as shown in recent data. Interestingly, this decline coincides with a rally in Bitcoin’s price, reaching up to $117,000. Typically, such price surges attract speculative trading activities, often resulting in higher Open Interest. However, this pattern was not observed in the current scenario for Bitcoin.

Solana’s Open Interest Movement

Solana, ranked as the sixth-largest cryptocurrency by market capitalization, has mirrored Bitcoin’s trend with a similar decline in Open Interest. Despite the price increase, the speculative interest has cooled down, suggesting a divergence in investor sentiment across different digital assets.

Diverging Trends Among Other Cryptocurrencies

In contrast to Bitcoin and Solana, Ethereum, the second-largest cryptocurrency, has experienced an increase in Open Interest. This trend implies a growing appetite for leveraged positions among investors, potentially signaling higher future volatility. Likewise, XRP and BNB have shown similar upward trends in their Open Interest metrics, highlighting a divergence in market behavior.

Current Bitcoin Price Movements

As of the latest update, Bitcoin’s price has seen a recovery to $117,900, although a minor pullback has brought it back to the $117,000 mark. This price movement over the last five days reflects the dynamic nature of the cryptocurrency market.

Commitment to Quality Content

At bitcoinist, our editorial process is dedicated to providing thoroughly researched, accurate, and unbiased content. We adhere to strict sourcing standards, with each article undergoing meticulous review by top technology experts and seasoned editors. This rigorous process ensures the integrity, relevance, and value of our content for our readers.