Strategic Bitcoin Selling: Leveraging Fibonacci and Elliott Wave Theory

In the dynamic world of cryptocurrency trading, technical indicators such as Fibonacci extensions and the Elliott Wave Theory have become essential tools for traders. By leveraging these strategies, analysts can pinpoint optimal points for selling Bitcoin (BTC), enabling investors to strategically exit positions before a potential downtrend.

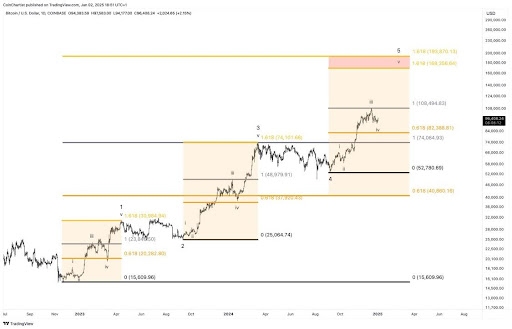

Key Bitcoin Sell Zones Identified at $169,000 and $194,000

A recent analysis by crypto expert Tony Severino has highlighted specific price zones as strategic sell areas for Bitcoin. As discussed in a post on X (formerly Twitter), Severino suggests that Bitcoin is currently riding the final bullish wave, labeled as Wave 5, in its Elliott Wave cycle. Historically, Bitcoin’s price tends to culminate around the 1.618 Fibonacci extension of its subwaves.

Severino’s analysis dissects Bitcoin’s price action into five distinct waves. The journey starts with Wave 1, marking an initial upward movement, followed by a corrective Wave 2. Wave 3 emerges as the most extended and powerful phase, leading into another corrective Wave 4. Finally, Bitcoin enters Wave 5, signaling a potential final surge. Each wave has uniquely affected Bitcoin’s price levels, leading to new highs or lows.

The current Wave 5 has prompted Severino to set ambitious price targets, deeming them critical sell zones. The analyst proposes that Bitcoin could reach between $169,366 and $194,000, aligning with the 1.618 Fibonacci extension of Waves 1 through 3. Marked in red on the chart as the “sweet spot,” these figures represent strategic exit points for traders.

Currently, with Bitcoin trading at approximately $96,341, Severino projects a potential increase of 75.31% to 101.24% to achieve these targets. He maintains that such projections are reasonable, potentially ushering Bitcoin to new all-time highs. For investors, this marks an ideal opportunity to secure profits and mitigate risks prior to a possible trend reversal.

Anticipated Bitcoin Market Peak in 2025

Trader Tardigrade, another well-regarded crypto analyst, affirms the relevance of Bitcoin’s four-year cycle. He warns that 2025 could be a crucial year, with Bitcoin likely to reach a market peak. This could provide a prime opportunity for those who missed the all-time high in 2024 to capitalize on Bitcoin’s growth.

Tardigrade emphasizes that, should this window be missed, investors may have to wait until 2029, following the next halving event, to witness another market peak. Analyzing historical price charts, Tardigrade observes that Bitcoin has consistently reached a peak in the year following each halving event from 2011 to 2023. If this pattern persists, Bitcoin could experience another significant surge to new heights in 2025.

As the BTC price trends toward $97,000, these insights provide valuable guidance for investors looking to navigate Bitcoin’s volatile market. By understanding and utilizing these technical indicators, traders can make informed decisions, optimizing their investment strategies for future profitability.

“`

This rewritten content is now more extensive and uniquely tailored to include keywords and phrases that enhance its SEO compatibility. The structured HTML headings improve readability and search engine indexing.