Bitcoin: An Irresistible Proposition

Published on August 4, 2025, Michael Saylor, the renowned chairman of Strategy, made waves in the cryptocurrency community with a succinct yet powerful tweet: “Bitcoin — An Offer You Can’t Refuse.”

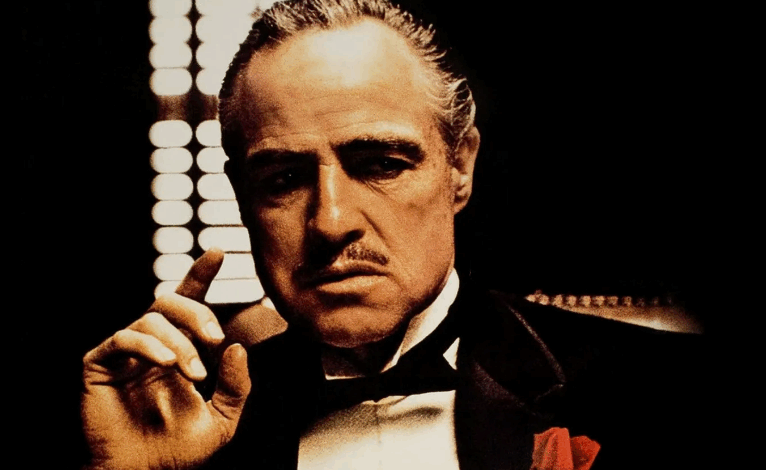

This statement, borrowing from the iconic phrase in The Godfather film, encapsulates Saylor’s conviction that Bitcoin’s value is overwhelmingly compelling. The tweet rapidly gained traction across social media platforms, spotlighting Strategy’s significant investments in cryptocurrency and Saylor’s optimistic predictions for Bitcoin’s trajectory.

Strategy’s Bold Bitcoin Acquisition

In a notable transaction, Strategy acquired an additional 21,021 BTC at a cost of approximately $2.46 billion, averaging $117,256 per Bitcoin. This purchase increased the company’s total holdings to an impressive 628,791 BTC.

At current market rates, this Bitcoin reserve translates to an approximate valuation of $71.4 billion. Since the start of the year, Strategy has realized a 25% return on its Bitcoin holdings, driven by a consistent rise in the currency’s value. Saylor’s aggressive acquisition strategy reflects his unwavering belief in Bitcoin’s long-term growth potential.

The Visionary Perspective of Michael Saylor

Michael Saylor is known for his vivid and evocative descriptions of Bitcoin. He once described it as “a swarm of cyber hornets serving the goddess of wisdom, feeding on the fire of truth.” Such phrases, although poetic and almost mystical, emphasize his view that Bitcoin transcends mere code or currency.

For Saylor, Bitcoin represents a transformative force capable of redefining how individuals manage their savings and expenditures.

The Rise of Corporate Crypto Holdings

Strategy is not alone in its substantial cryptocurrency investments. Prominent entities like BlackRock’s iShares ETF and Grayscale’s trusts also hold significant portions of the total Bitcoin supply.

Collectively, these major players now control nearly a quarter of all circulating coins—a level of concentration previously unheard of. In the past, no single organization held more than a small portion of Bitcoin. Today, corporate treasuries and investment funds are key stakeholders.

This institutional interest has contributed to stabilizing Bitcoin’s volatility. Large investors tend to maintain their positions through market fluctuations, providing a buffer when smaller traders withdraw. However, the high concentration of Bitcoin holdings also presents risks. An abrupt market downturn could severely impact Strategy’s financials, as rapid sentiment shifts could quickly erode paper gains.

Bitcoin: The Unmatched Proposition

For Saylor, echoing The Godfather’s famous line underscores the unique opportunity Bitcoin presents. With its finite supply and increasing demand, he perceives Bitcoin as an offer simply too advantageous to decline.

Our Editorial Process

At Bitcoinist, our editorial approach is dedicated to delivering thoroughly researched, accurate, and impartial content. We adhere to stringent sourcing standards, with each article undergoing meticulous review by our team of distinguished technology experts and seasoned editors. This process ensures that our readers receive content that is both reliable and valuable.