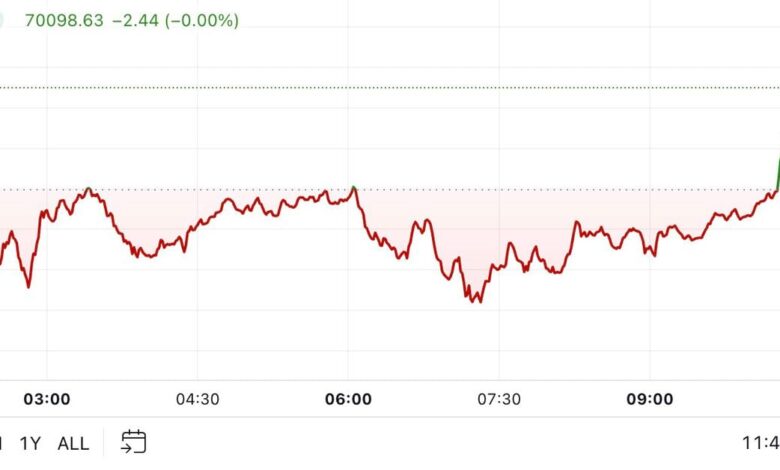

Bitcoin has managed to rebound from its recent dip, climbing back to $70,000 during the European morning trading hours. The leading cryptocurrency had briefly dropped to $68,800 before bouncing back. Despite the recovery, BTC is still down around 3% over the past 24 hours. Meanwhile, altcoins have experienced even greater losses, with the CoinDesk 20 Index showing a decline of over 3.5% in the broader crypto market.

There are various factors being cited for the recent market turbulence. Some analysts suggest that traders are taking profits following the recent rally, while others point to a decrease in Donald Trump’s election victory odds on the prediction market platform Polymarket. Additionally, investors are closely monitoring developments such as tech earnings reports, geopolitical tensions between Iran and Israel, and a significant increase in U.K. gilt yields following the unveiling of the government budget earlier this week.

Quinn Thompson, the founder of crypto hedge fund Lekker Capital, highlighted the impact of these external factors on the cryptocurrency market. As the market continues to navigate through these uncertainties, traders are advised to stay vigilant and monitor the latest developments closely.